Navigating the shift to sustainable solutions in hospitality & foodservice supply chains.

The global economy is undergoing a fundamental shift away from single-use plastics, driven by an undeniable imperative: environmental sustainability. For B2B decision-makers across procurement, operations, sustainability, and supply chain management, this isn’t merely an environmental concern; it’s a high-stakes operational and commercial challenge. The transition to eco-friendly alternatives is no longer optional but a critical strategic maneuver to maintain market access, ensure compliance, and meet escalating consumer and stakeholder demands.

Compostable straws have emerged as a pivotal solution in this paradigm shift. Their adoption is accelerating rapidly, fueled by a powerful convergence of stringent regulatory mandates, an increasingly environmentally conscious consumer base, and proactive corporate sustainability initiatives. Businesses failing to adapt risk significant fines, reputational damage, and erosion of customer trust, ultimately impacting their bottom line and long-term viability. This analysis delves into the primary markets propelling the demand for compostable straws, offering a strategic roadmap for B2B leaders navigating this evolving landscape.

Sources: UNEP (2023) on global plastic pollution, European Commission (2021) on SUPD enforcement, NielsenIQ (2023) on consumer sustainability preferences.Embracing compostable straws is a strategic imperative for B2B leaders in hospitality and foodservice.

The Foodservice & Hospitality Sector: A Primary Driver for Compostable Straws

The foodservice and hospitality industries stand at the vanguard of the compostable straw revolution, driven by their direct interface with consumers and the sheer volume of single-use items they dispense daily.

Quick-Service Restaurants (QSRs) and Coffee Chains Lead Adoption with 52.8% Market Share

The quick-service restaurant (QSR) and coffee chain segments are the undisputed leaders in compostable straw adoption. This foodservice sector is projected to command a dominant52.8%of the compostable straws market in 2025. Major global players like McDonald’s and Starbucks have been at the forefront of this transition, driven by ambitious corporate sustainability goals and the evolving dining norms that prioritize green packaging.

Their widespread transition sets a precedent for the entire industry. As consumers increasingly prefer eco-friendly choices, QSRs and coffee chains recognize that embracing compostable solutions is not just about compliance, but about enhancing brand image and attracting a growing segment of environmentally conscious patrons.

Full-Service Restaurants, Hotels, and Catering Embrace Sustainable Straws

Beyond fast-casual, full-service restaurants, hotels, and catering services are rapidly integrating compostable straws into their operations. This shift aligns seamlessly with their broader zero-waste and Environmental, Social, and Governance (ESG) compliance objectives. The increasing consumption of ready-to-drink products within these settings necessitates a scalable, eco-friendly straw option. Forhotels and airlines, specifically, adopting individually wrapped compostable straws offers a strategic advantage, combining hygiene compliance with significant ROI opportunities through enhanced brand perception and reduced waste management costs. Discover more about how these sectors benefit by exploring our insights onhow hotels and airlines gain a strategic advantage with individually wrapped compostable straws.Hospitality and foodservice sectors are primary drivers for compostable straw demand.

Global Regulatory Frameworks Accelerating Compostable Straws Adoption

Government legislation and regulatory mandates are undeniably the most forceful catalysts for the widespread adoption of compostable straws, compelling businesses to adapt or face significant repercussions.

European Union’s Single-Use Plastics Directive (EU SUPD) Impact

The European Union’s Single-Use Plastics Directive (EU SUPD), rigorously enforced since 2021, has been a pivotal legislative trigger. This directive effectively bans numerous single-use plastic items, including straws, across member states. Countries such as the UK, Germany, France, and Italy have consequently experienced a surge in demand for certified compostable alternatives.

The EU SUPD’s comprehensive nature means that hospitality venues operating within Europe must procure straws that are certified compostable to ensure compliance. Failure to adhere to these regulations can result in substantial fines and operational disruptions, highlighting the critical need for robust procurement strategies that prioritize certified solutions. More details on the EU SUPD can be found on theEuropean Commission website.

North American State and City Bans Propel Demand, with US CAGR of 7.5%

While the U.S. lacks a federal plastic ban, North America leads the global market share for compostable straws, largely propelled by a patchwork of aggressive state and city-level regulations. The U.S. market, in particular, is projected to grow at a Compound Annual Growth Rate (CAGR) of7.5%. States like California and New York have implemented sweeping restrictions on single-use plastics, driving widespread adoption.

A notable example is San Francisco’s 2020 law, which mandates that all single-use foodware, including straws, must be certified BPI (Biodegradable Products Institute) or TÜV AUSTRIA compostable. This emphasis on third-party certification underscores the need for B2B buyers to verify the authenticity and true compostability of their chosen solutions. Canada has also enacted federal bans on single-use plastics, including straws, further solidifying North America’s leadership in this market.

Asia-Pacific’s Proactive Stance on Plastic Waste Fuels Fastest Growth

The Asia-Pacific region is emerging as the fastest-growing market for compostable straws, driven by rapid urbanization, rising disposable incomes, and increasingly proactive government initiatives to curb plastic waste. Countries like South Korea have set ambitious goals, such as achieving carbon neutrality by 2050, which directly bolsters the adoption of eco-friendly alternatives. Japan and India are also actively researching and implementing strategies to significantly reduce plastic consumption. This regional momentum is creating vast opportunities for manufacturers and suppliers of compostable products.Global regulations are a powerful catalyst for compostable straw adoption across all markets.

Consumer Demand & Corporate ESG Drive the Shift to Compostable Straws

Beyond regulations, the seismic shift in consumer preferences and the growing emphasis on Corporate Social Responsibility (CSR) and ESG metrics are powerful forces shaping procurement decisions.

80% of Consumers Prefer Eco-Friendly Products, Influencing Procurement

A staggering80%of consumers globally now prefer eco-friendly products, directly influencing purchasing decisions at every level. This growing global consciousness about environmental issues and the devastating impact of plastic pollution on oceans and ecosystems is compelling businesses to act. Consumers are increasingly willing to pay a premium for sustainable choices, placing immense pressure on businesses to integrate green packaging and practices. For decision-makers, embracing eco-friendly product offerings isn’t just a trend; it’s a strategic imperative for competitive advantage and long-term brand loyalty.

Major Corporations Invest in Sustainable Straws as Part of Green Initiatives

Leading corporations, recognizing the dual benefits of environmental stewardship and enhanced brand reputation, are actively investing in sustainable straw solutions. The Coca-Cola Company, for instance, has transitioned to FSC-accredited biodegradable and recycled paper straws in various markets, phasing out plastic alternatives. Adopting certified compostable solutions demonstrates a genuine commitment to CSR, meeting the evolving expectations of stakeholders, investors, and customers alike. This proactive approach helps companies differentiate themselves in a crowded marketplace and build a resilient brand image.

Mini Case Study: Starbucks Korea & Paris Baguette Lead South Korean Market Shift

South Korea exemplifies the powerful combination of government mandates and corporate leadership driving market transformation. In alignment with the nation’s “Zero Waste” campaign and its ambitious 2050 carbon neutrality goal, major chains have taken decisive action. Starbucks Korea has been a trailblazer, actively adopting compostable straws across its extensive network of cafes. Following suit, Paris Baguette, another prominent bakery and cafe chain, significantly expanded its use of compostable straws. These high-profile adoptions have not only reduced plastic waste but have also driven substantial market expansion for compostable straw manufacturers in the region, illustrating the ripple effect of large-scale corporate commitments.Consumer demand and corporate ESG goals are powerful forces for sustainable straw adoption.

Emerging Markets & Expanding Applications for Eco-Friendly Straws

The reach of compostable straws extends far beyond traditional foodservice, permeating new sectors and applications as the sustainability movement gains momentum.

Retail and E-commerce Channels Broaden Accessibility

The growth of retail and e-commerce channels has significantly broadened the accessibility of diverse eco-friendly straw options. Supermarkets, hypermarkets, and online stores are increasingly stocking a variety of compostable straws, catering directly to individual consumers who are adopting zero-waste lifestyles for household use. This proliferation creates new distribution channels and market segments, moving beyond reliance on traditional commercial foodservice procurement.

Events and Festivals Adopt Eco-Friendly Straws for Large Gatherings

Large-scale public events, music festivals, sports venues, and concerts are increasingly promoting sustainability through green practices. This includes widespread adoption of compostable straws to minimize environmental impact from single-use items. Similarly, corporate events are integrating compostable solutions to align with their sustainability pledges, demonstrating commitment to a broad audience and reinforcing responsible business practices.

Healthcare and Educational Institutions Join the Green Movement

Even sectors traditionally slower to adopt green initiatives are making strides. Medical facilities and hospitals are beginning to utilize biodegradable straws to align with their broader sustainability policies and waste reduction goals. Similarly, schools and universities are encouraging the use of eco-friendly options, not only for practical reasons but also as a vital component of environmental education and promoting responsible consumption among students and staff. Public sector institutions are increasingly prioritizing ESG compliance in their procurement processes, further expanding the market for compostable solutions.Compostable straws are expanding into new markets like retail, events, healthcare, and education.

Innovation & Market Projections for Compostable Straws

The market for compostable straws is characterized by rapid innovation in materials science and manufacturing, underpinning impressive growth projections.

Advancements in Materials: Paper, PLA, and Beyond for Durable Compostable Straws

The landscape of compostable straw materials is continuously evolving to enhance performance, durability, and user experience. Paper straws are currently projected to dominate the market, holding a44.3%market share in 2025, largely due to their established eco-friendly credentials and widespread availability. However, innovations are pushing beyond basic paper, incorporating new multi-layered coatings that significantly improve durability and prevent the common issue of sogginess.

Polylactic Acid (PLA), derived from renewable plant-based bioplastics (like cornstarch), offers a compostable alternative with a feel closer to traditional plastic, known for its rigidity. Other emerging materials include sugarcane, bamboo, wheat, rice, seaweed, and even pasta. These advancements are critical for ensuring that compostable straws meet the practical demands of various beverage applications without compromising the consumer experience. Understanding the distinctions between these materials is crucial for procurement, and ourB2B guide on compostable vs. biodegradable strawsprovides further detail.

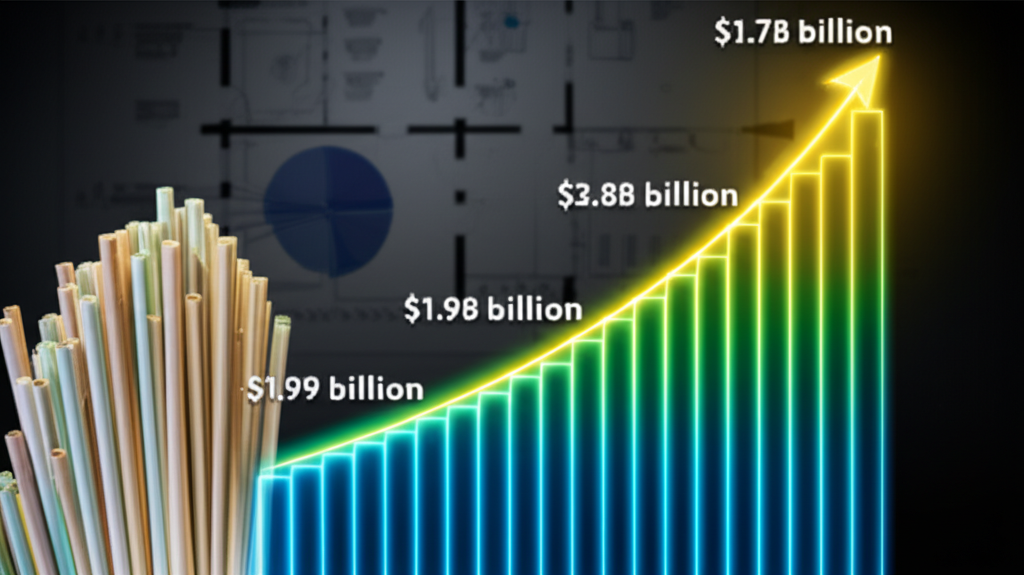

Global Market Growth Projections: From $1.9 Billion to $3.8 Billion by 2035

The robust growth trajectory of the compostable straws market signifies a major, irreversible shift in the beverage packaging industry. The global compostable straws market is projected to expand significantly, from USD1.9 billion in 2025 to USD 3.8 billion by 2035, exhibiting a Compound Annual Growth Rate (CAGR) of 7.1%. When looking at the broader eco-friendly straws market, which includes all sustainable alternatives, the value is estimated at approximately USD 12.3 billion in 2025, with projections indicating growth to nearly USD 25.1 billion by 2035 at a CAGR of 7.3%. This substantial market expansion underscores the accelerating demand and investment in sustainable solutions.

Navigating Disposal Infrastructure Challenges for Optimal Composting

Despite the advancements in materials, a significant challenge for the compostable straw market remains the disposal infrastructure. For many compostable materials, particularly PLA, effective biodegradation requires specific industrial composting facilities. The lack of widespread access to such infrastructure in all regions can hinder the full circularity of these products, leading to them potentially ending up in landfills if not properly sorted. Strategic collaborations between B2B suppliers and waste management companies are essential to develop robust collection and processing systems. Businesses must understand the proper disposal methods for certified compostable products to ensure their environmental benefits are fully realized. OurB2B playbook for sustainable waste managementoffers practical guidance.Innovation in materials and strong market projections define the compostable straw industry.

Comparison Table: Compostable Straw Technologies for B2B Adoption

Making the right procurement decision requires understanding the operational, compliance, and financial implications of various compostable straw options.

| Feature | B2B operationel effekt | Overholdelsesnotat | ROI-potentiale |

|---|---|---|---|

| Papirsugerør | Widely available, cost-effective for high volume use; diverse sizes. | Generally compliant with most single-use plastic bans; check for durability (sogginess) depending on application. | High customer satisfaction due to eco-friendly choice; positive brand image; reduces plastic waste fines; broad market acceptance. |

| PLA sugerør | Offers superior rigidity and mouthfeel compared to paper, similar to traditional plastic. | Requires industrial composting facilities; certified to ASTM D6400 or EN 13432 standards. | Enhanced user experience leading to repeat business; strong alignment with sustainability goals; appeals to discerning eco-conscious consumers; supports circular economy initiatives. |

| Sugarcane/Bamboo Straws | Durable, unique natural texture; often higher unit cost than paper or PLA; artisanal appeal. | Excellent natural biodegradability; ensures compliance with strict environmental policies and green certifications. | Premium brand perception and differentiation; niche market appeal for high-end or specialty venues; long-term environmental benefits and reduced ecological footprint. |

Choosing the right compostable straw requires understanding operational, compliance, and financial implications.

Competitive Advantage & Business Case

For B2B leaders, the decision to adopt compostable straws extends beyond mere compliance; it’s a powerful opportunity to forge competitive advantage and build a robust business case.

Quantifiable benefits include significant risk mitigation. By proactively transitioning to certified compostable solutions, businesses can avoid substantial fines associated with evolving plastic bans and safeguard their operations against future regulatory changes. This foresight ensures uninterrupted market access in regions with strict environmental policies, such as the EU.

Moreover, the brand value uplift is considerable. With 80% of consumers favoring eco-friendly products, embracing compostable straws directly enhances brand reputation and cultivates consumer loyalty. This positive public perception can translate into increased sales and market share. For instance, in the foodservice sector, which commands over 50% of the market, offering sustainable options can be a key differentiator, attracting eco-conscious customers and potentially allowing for premium pricing. Beyond direct sales, a strong sustainability commitment also appeals to ESG-focused investors and talented employees, bolstering a company’s overall market standing and long-term resilience. The transition also supports the broader circular economy by reducing reliance on finite resources and promoting waste diversion.Adopting compostable straws offers significant competitive advantages and a strong business case.

Ofte stillede spørgsmål (ofte stillede spørgsmål)

What are compostable straws and why are they important for hospitality and foodservice?

Compostable straws are eco-friendly alternatives to traditional plastic straws, designed to break down into natural elements. They are crucial for hospitality and foodservice to meet regulatory mandates, consumer demand for sustainability, and enhance brand reputation while reducing plastic waste.

How do global regulations impact the adoption of compostable straws in B2B sectors?

Regulations like the EU Single-Use Plastics Directive and various state/city bans in North America compel businesses to switch to certified compostable straws. Failure to comply can result in significant fines and operational disruptions, making compliance a key driver for B2B procurement.

What are the key benefits for hotels and airlines adopting individually wrapped compostable straws?

Hotels and airlines gain a strategic advantage by combining hygiene compliance with significant ROI opportunities. This includes enhanced brand perception, reduced waste management costs, and meeting the expectations of environmentally conscious travelers, leading to increased customer loyalty.

What are the different types of materials used for compostable straws?

Common materials include paper, Polylactic Acid (PLA) derived from plant starches, and natural materials like sugarcane, bamboo, wheat, rice, and even pasta. Each offers different characteristics in terms of durability, feel, and composting requirements.

What challenges exist in the disposal of compostable straws?

A significant challenge is the need for specific industrial composting facilities for many compostable materials, particularly PLA. Lack of widespread access to such infrastructure can lead to these products ending up in landfills if not properly sorted, hindering their full environmental benefit.

How can adopting compostable straws provide a competitive advantage for businesses?

Beyond compliance, adopting compostable straws mitigates risks from evolving plastic bans, ensures market access, and significantly uplifts brand value. It attracts eco-conscious consumers, appeals to ESG-focused investors, and differentiates businesses in a crowded marketplace, fostering long-term resilience.FAQs address common pain points and provide actionable solutions for B2B leaders.

Conclusion: Seizing the Sustainable Advantage with Compostable Straws

The demand for compostable straws is no longer a niche trend but a critical imperative, driven by the powerful forces of regulatory mandates, consumer preferences, and corporate sustainability goals. Key markets, especially the foodservice and hospitality industries, are at the forefront of this transformation, supported by rapid innovation in materials and encouraging market projections. B2B leaders who proactively adopt certified compostable solutions will not only ensure compliance with evolving standards but also capture significant market share, enhance brand loyalty, and build enduring competitive advantage in the evolving sustainable economy.Act now: Evaluate your current straw usage and transition to certified compostable straw solutions to enhance your environmental stewardship and secure a competitive edge in the evolving sustainable economy. Don’t wait for regulation to dictate your strategy—lead the change.Proactive adoption of compostable straws secures competitive advantage and ensures compliance.