A Guide for Procurement Managers, Operations Directors, and Sustainability Officers in Hospitality & Foodservice

The global shift towards sustainability has propelled Polylactic Acid (PLA) straws into the spotlight as an eco-friendly alternative to traditional plastics. For procurement managers, operations directors, and sustainability officers, this presents both a significant opportunity and a complex challenge. The market for PLA degradable straws alone is projected to surge from an estimated $500 million in 2025 to approximately $1.8 billion by 2033, driven by increasing environmental regulations and consumer demand, with over 70% of consumers preferring businesses that use eco-friendly options. However, understanding the true nature of PLA’s compostability is paramount. Missteps in material choice and waste management can lead to severe compliance risks, damaged brand reputation, and operational inefficiencies, turning a green initiative into a costly liability.

Understanding PLA’s true compostability is crucial for hospitality and foodservice businesses to avoid compliance risks and reputational damage.

What are PLA Straws, and Why the Hype?

PLA straws are a type of bioplastic, typically engineered from fermented plant starches such as corn, sugarcane, cassava, or sugar beet pulp. This plant-based origin is a significant part of their appeal, as their production utilizes approximately 68% fewer fossil fuel resources compared to conventional plastics, directly aligning with corporate carbon footprint reduction goals. Designed to mimic the appearance, feel, and strength of traditional plastic straws, PLA offers a familiar user experience while being marketed as “biodegradable, eco-friendly, and compostable.” This perceived environmental benefit makes them an attractive solution for businesses striving to meet growing consumer demand for sustainable practices.

PLA straws, made from plant starches, offer a familiar user experience while reducing fossil fuel reliance.

The Nuance of “Compostable”: Understanding PLA Straws’ Requirements

Despite the prevalent marketing, the term “compostable” for PLA straws comes with critical conditions. Unlike truly biodegradable materials that break down naturally in diverse environments, PLA’s decomposition is highly dependent on a controlled setting. This distinction is crucial for B2B decision-makers assessing their environmental impact and regulatory compliance.

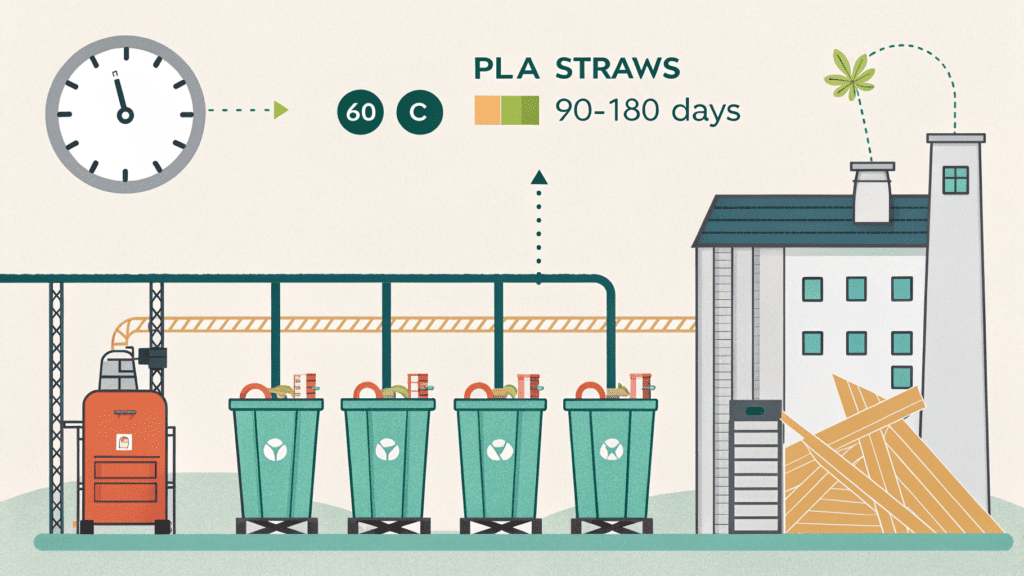

The Industrial Composting Imperative: Temperatures and Timeframes for PLA Straws

PLA straws unequivocally require industrial composting facilities to break down effectively. These specialized environments maintain sustained high temperatures, typically above 140 degrees Fahrenheit (60 degrees Celsius), for at least 10 consecutive days. Under these ideal, controlled conditions, PLA straws are designed to decompose into water, carbon dioxide, and organic matter, generally within 90 to 180 days. Peer-reviewed research, such as studies utilizing the EN ISO 14855-1:2012 European Standard, confirms PLA’s ability to compost within 90 days when subjected to these rigorous conditions, measuring CO2 generation as an indicator of biodegradation.

The Home Composting & Landfill Limitations of PLA Straws

The effectiveness of PLA composting drastically changes outside of industrial settings. PLA straws generally do not decompose in home composting bins or backyard systems because these environments simply lack the sustained high temperatures and controlled microbial activity necessary for their breakdown. More critically, if PLA straws end up in landfills or natural environments like oceans, they can persist for hundreds or even thousands of years, behaving similarly to traditional plastics. Studies have explicitly shown that PLA straws do not readily degrade in ocean water, posing a threat to marine wildlife akin to conventional plastic pollution.

Certification Standards for PLA Straws: BPI, EN 13432, and ASTM D6400

To truly ensure industrial compostability and mitigate “greenwashing” concerns, businesses must prioritize certified PLA products. Reputable certifications such as BPI (Biodegradable Products Institute) in North America or TÜV Austria’s “OK compost INDUSTRIAL” verify that products meet stringent standards. These certifications align with global benchmarks like ASTM D6400 (North America) and EN 13432 (Europe), which mandate that products break down into organic matter without leaving toxic residues within specific timeframes. TheEU Single-Use Plastics Directive (2019/904), enforced since 2021, prohibits non-certified single-use plastic straws, even if “bio-sourced,” making certified compostable straws the compliant choice for European market access. Understanding these distinctions is critical for procurement and sustainability teams, as explored in depth in our guide oncompostable vs. biodegradable straws.

PLA straws require industrial composting facilities and specific certifications like BPI or EN 13432 for true breakdown.

Operational Challenges and Environmental Misconceptions of PLA Straws

Despite their perceived environmental benefits, integrating PLA straws into existing waste management systems presents significant hurdles for businesses. These challenges often stem from PLA’s unique physical characteristics and the limitations of current infrastructure, leading to operational complexities and environmental inefficiencies if not properly addressed.

Contamination Risks in Recycling Streams with PLA Straws

A major operational headache for businesses is the contamination risk posed by PLA straws in recycling streams. PLA straws cannot be mixed with other common types of plastics, such as PET (polyethylene terephthalate) or HDPE (high-density polyethylene), for curbside recycling. This is due to PLA’s lower melting temperature, which, if mixed, contaminates the entire batch of recyclable plastics, often rendering it unsellable and destined for a landfill. Many municipalities and recycling facilities simply do not accept PLA, labeling it a contaminant, thus complicating proper disposal and increasing waste management costs.

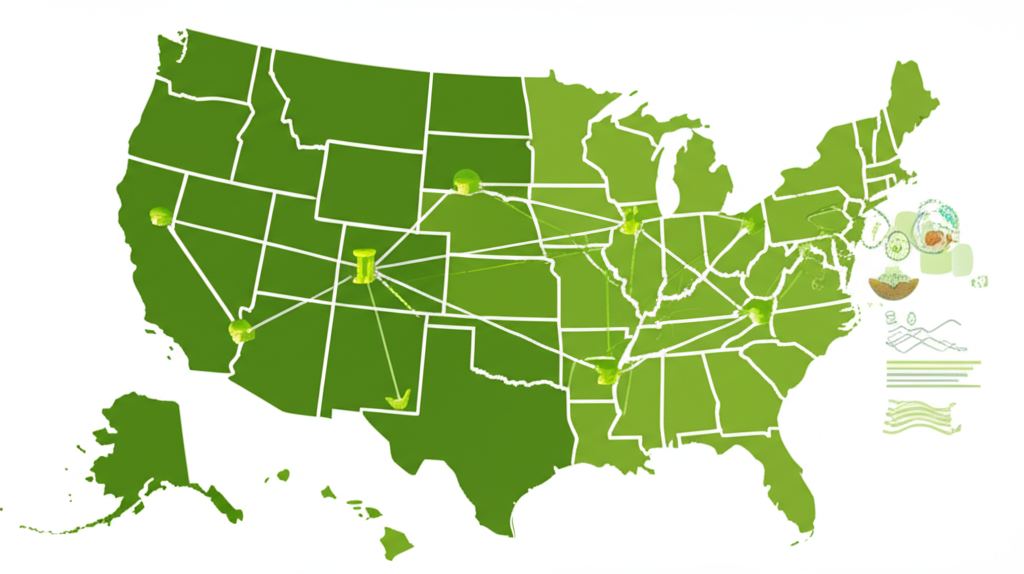

The Infrastructure Gap: Limited Industrial Composting Facilities in the U.S.

A significant systemic barrier to effective PLA composting is the scarcity of appropriate facilities. Despite the technical compostability of PLA, the necessary infrastructure for processing it is severely lacking. As of January 2023, only about 49 out of 47,000 composting facilities in the U.S. accept compostable plastic materials, with most concentrated on the West Coast. This glaring infrastructure gap means that a substantial majority of PLA straws, despite being theoretically “compostable,” ultimately end up in landfills, negating their environmental purpose. For businesses aiming to manage BPI-certified compostable products effectively, understanding and navigating this infrastructure challenge is crucial, as detailed in ourB2B playbook for sustainable waste management.

“Greenwashing” Concerns and Methane Emissions from PLA Straws

The marketing of PLA straws as broadly “biodegradable” or “eco-friendly” without clear, precise disposal instructions contributes significantly to “greenwashing” concerns. When bioplastics like PLA end up in anaerobic landfill conditions—where oxygen is scarce—they can still release methane, a potent greenhouse gas that is far more impactful than carbon dioxide over a 20-year period. This paradox undermines the very environmental benefits they are intended to provide. The lack of standardized federal regulations in the U.S. for terms like “bioplastic” or “compostable” products further exacerbates this confusion, making it challenging for businesses and consumers alike to make truly informed, environmentally responsible choices.

PLA straws pose contamination risks in recycling and face infrastructure gaps, leading to “greenwashing” concerns and methane emissions.

Market Dynamics: The Growing Demand for Sustainable Straws, Including PLA Straws

The escalating demand for sustainable alternatives is a powerful force reshaping the B2B market, presenting both significant opportunities and competitive pressures for businesses. Companies are increasingly leveraging eco-friendly options not only to meet evolving regulatory demands but also to profoundly enhance their brand appeal and deepen customer loyalty.

Global Market Growth and Regulatory Tailwinds for Bioplastic Straws

The global eco-friendly straws market is projected to grow from approximately USD 12.3 billion in 2025 to nearly USD 25.1 billion by 2035, at a robust Compound Annual Growth Rate (CAGR) of 7.3%. Within this burgeoning sector, the PLA degradable straw market specifically is estimated at $500 million in 2025 and is projected to reach $1.8 billion by 2033, demonstrating an impressive 15% CAGR. This rapid expansion is significantly bolstered by stringent regulations, such as the EU Single-Use Plastics Directive, which became effective in 2021, and a growing number of U.S. state-level bans on single-use plastics. These legislative mandates compel businesses across the foodservice and hospitality sectors to adopt sustainable alternatives, making compliant, certified options a business imperative.

B2B Opportunities for Procurement Managers in the PLA Straw Market

For astute procurement managers, the expanding market for sustainable straws, including PLA, presents clear opportunities. There is significant potential to capitalize on the increasing demand from the foodservice and hospitality sectors, driven by corporate social responsibility initiatives and strong consumer preference for eco-conscious products. Leading suppliers, such as Pando EP Technology, established in 1996, have already forged partnerships with major Quick-Service Restaurant (QSR) and Fast-Moving Consumer Goods (FMCG) companies globally, including Nestlé and Yum!, demonstrating the viability and scale of this market. Adopting certified compostable PLA straws not only ensures regulatory compliance but also significantly enhances brand positioning, attracting and retaining eco-conscious customers who are often willing to pay a premium for businesses committed to sustainable practices.

The sustainable straw market is rapidly growing, offering B2B opportunities for procurement managers to enhance brand and ensure compliance.

Comparison of Eco-Friendly Straw Alternatives

Choosing the optimal straw alternative requires a comprehensive evaluation of operational impact, compliance considerations, and potential return on investment. The market offers a diverse range of materials, each with distinct advantages and limitations.

| Besonderheit | B2B Betriebswirkung | Compliance Note | ROI -Potenzial |

|---|---|---|---|

| Pla Strohhalme | Require separate waste streams for industrial composting; high potential for recycling contamination if mis-sorted. Sensitive to high heat, may soften with hot liquids. | BPI/EN 13432 certification for industrial compostability is essential for true environmental claims and regulatory compliance. | Reduces fossil fuel reliance (-68%); brand enhancement; often a higher initial cost than traditional plastic, but lower than some advanced bioplastics. Cost savings on fines for non-compliance. |

| PHA-Strohhalme | Offer broader disposal options, including home and marine compostability, reducing the burden on specialized infrastructure. Potential for premium product positioning. | Certifiable for home, commercial, and marine degradation (e.g., TÜV AUSTRIA OK compost HOME/MARINE), offering more versatile environmental compliance pathways. | Stronger long-term sustainability ROI due to wider degradation capabilities and reduced risk of landfilling. May have a higher initial cost than PLA but offers enhanced eco-credentials and market differentiation. |

| Papierstrohhalme | Widely accepted and familiar disposal methods; prone to sogginess unless specifically coated. | Generally compliant with plastic bans; check for certifications verifying biodegradability, compostability, and importantly, PFAS-free status. | Lower initial cost than most bioplastics; rapid breakdown (typically 30-60 days) in industrial composting; high consumer familiarity. Potential for negative customer experience if performance is poor (e.g., sogginess). |

| Sugarcane Bagasse | Durable, water-resistant, and generally maintains structural integrity well. Typically compostable in home or industrial facilities. | Often home compostable and industrially compostable, aligning with broad sustainability goals and diverse disposal scenarios. | Strong eco-friendly image due to upcycling agricultural byproduct; effective performance; competitive pricing with other compostable options. Good for brand value and avoids performance complaints. |

| Wiederverwendbar (Metall/Glas) | Requires significant operational overhead including washing, sanitization, storage, and inventory management. Higher upfront investment. | Reduces waste to near zero, meeting the strictest sustainability mandates and promoting a circular economy. | High long-term ROI through repeat use, eliminating recurring straw procurement costs. Strongest brand commitment to circularity and deep consumer loyalty. Requires consumer buy-in for off-premise use. |

PHA Straws: A Next-Generation Bioplastic Alternative

PHA (Polyhydroxyalkanoate) straws, often derived from renewable sources like canola oil, represent a significant advancement over PLA in terms of biodegradability. They are engineered to break down in a wider array of environments, including commercial composting facilities, home composting bins, and even marine settings, typically within months. This broader degradability profile addresses many of the infrastructure limitations associated with PLA, offering a more universally viable end-of-life solution. Companies like Good Start Packaging have notably transitioned from PLA to PHA straws, recognizing the latter’s faster and more versatile compostability as a key differentiator for their B2B clients.

Other Compostable Straw Materials: Paper, Sugarcane, and More

Beyond PLA and PHA, the market offers several other compelling compostable straw materials. Paper straws are a leading alternative, projected to hold a substantial 44.3% market share in 2025 due to their widespread availability, relative cost-effectiveness, and full biodegradability and compostability. However, their performance can vary, with some prone to sogginess unless treated with advanced, food-safe coatings. Sugarcane bagasse straws, made from a fibrous byproduct of sugarcane processing, offer a durable, water-resistant, and versatile option, being compostable in both home and industrial settings. Emerging alternatives include straws made from rice, wheat, pasta (which can be edible), agave, and coffee grounds, each presenting unique properties and environmental benefits. For a comprehensive look at how different materials are classified, see our guide onBPI Compostable vs. Biodegradable.

PHA straws offer broader degradability than PLA, while paper and sugarcane provide other viable compostable alternatives.

Case Study: Good Start Packaging’s Shift to Truly Compostable PHA Straws

In a pivotal strategic move within the eco-friendly foodservice industry, Good Start Packaging, a prominent supplier of sustainable products, made the decision to phase out its offerings of PLA straws in favor of PHA (polyhydroxyalkanoate) straws. This significant transition, observed within the last three years, was directly motivated by a clear-eyed assessment of PLA’s practical limitations. While PLA is technically industrially compostable, the widespread lack of accessible commercial composting infrastructure across many regions meant that Good Start Packaging’s PLA products frequently ended up in landfills.

Recognizing this critical gap between ideal conditions and real-world disposal, the company sought a more genuinely sustainable solution. PHA straws, in contrast, offered a superior environmental profile with certified home compostability and marine degradability, providing a robust end-of-life solution that was not reliant on scarce industrial facilities. This proactive and transparent shift by an industry leader underscores the importance of rigorous due diligence in sustainable procurement. It highlights a business responding directly to the challenges of PLA disposal and prioritizing a more universally viable and truly compostable alternative, thereby aligning its product offerings with its deep commitment to genuine environmental impact.

Good Start Packaging transitioned from PLA to PHA straws due to PHA’s superior, more versatile compostability and broader infrastructure compatibility.

Strategic Considerations for B2B Decision-Makers

For procurement managers, operations directors, and sustainability officers, navigating the landscape of sustainable straws transcends mere label reading. It necessitates a strategic, holistic approach that considers the entire lifecycle of a product, from sourcing to its ultimate end-of-life. Understanding the disposal realities and infrastructure limitations is paramount for ensuring genuine environmental impact and effectively mitigating operational risks.

Due Diligence Beyond the “Compostable” Label for PLA Straws

The initial step in responsible procurement is rigorous due diligence. Simply seeing the term “compostable” is insufficient. Decision-makers must actively verify certifications, such as BPI (Biodegradable Products Institute) or TÜV AUSTRIA’s “OK compost INDUSTRIAL,” to ensure products meet stringent industrial composting standards. Furthermore, a critical understanding of local composting infrastructure availability is indispensable. With only approximately 15% of U.S. composting facilities currently accepting bioplastics, many “compostable” items, including PLA straws, are diverted to landfills where they may persist for centuries. Prioritize transparent suppliers who can provide clear information regarding material composition, end-of-life instructions, and ideally, proof of partnerships with commercial composting facilities in your operational areas to avoid the pitfalls of “greenwashing.”

Optimizing Waste Management for PLA Straws and Other Bioplastics

Effective waste management is the linchpin for realizing the environmental benefits of PLA and other bioplastics. Businesses must implement clear, unambiguous internal sorting protocols to prevent PLA straws from contaminating traditional recycling streams. Given PLA’s lower melting temperature compared to common plastics like PET, commingling can render entire recycling batches unusable. Therefore, establishing dedicated collection bins for compostable materials is essential. Beyond internal protocols, businesses should actively partner with commercial composting facilities or waste management providers specifically equipped to handle bioplastics. For regions lacking such infrastructure, exploring advanced bioplastics like PHA, which offer more flexible disposal options including home and marine degradation, becomes a strategic imperative.

Enhancing Brand Reputation and Compliance with Sustainable Straws

Proactive adoption of genuinely sustainable straw solutions is a powerful lever for enhancing brand reputation and ensuring regulatory compliance. Communicate transparently with your customers about your sustainable choices and provide clear instructions for proper disposal, fostering trust and aligning with the values of eco-conscious consumers. This commitment directly contributes to broader Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) goals, which are increasingly important for investor relations and market positioning. By proactively adopting certified compostable solutions, such as those meeting theASTM D6400standard for industrial compostability, businesses can ensure compliance with evolving regulations, like the EU Single-Use Plastics Directive and various U.S. state-level bans, mitigating the risk of penalties and positioning themselves as industry leaders.

B2B decision-makers must conduct due diligence, optimize waste management, and enhance brand reputation through certified sustainable straw choices.

Future Trends & Innovation

The landscape of sustainable straws is dynamic, driven by continuous innovation and evolving regulatory pressures. Looking 5–10 years ahead, we anticipate several key trends that will redefine B2B procurement in this space:

- Rise of Truly Degradable Materials: There will be an accelerated shift towards materials with genuinely broader degradability profiles, moving beyond reliance on specialized industrial facilities. PHA and other next-generation bioplastics capable of decomposing in home composting, soil, and marine environments will see increased adoption.

- AI-Driven Material Science: Artificial intelligence will play a transformative role in research and development, rapidly identifying and optimizing new high-performance bio-based polymers, accelerating the discovery of even more sustainable and efficient materials.

- Advanced Performance & Functionality: Innovations will overcome historical performance issues such as sogginess, brittleness, and heat sensitivity. We’ll see compostable straws that perform identically to, or even surpass, traditional plastics in durability, temperature resistance (up to 90°C/194°F for hot beverages), and user experience.

- Circular Economy Integration: The industry will increasingly focus on closed-loop systems, integrating agricultural byproducts and waste streams directly into straw production. This includes scaling up production of straws made from materials like seaweed, coffee grounds, and agricultural residue, contributing to a more circular economy.

- Standardization & Transparency: Greater regulatory clarity and widespread adoption of standardized evaluation criteria for biodegradability and compostability will reduce “greenwashing” and foster true environmental accountability. This will make procurement decisions clearer and more impactful.

- Localized Solutions & Infrastructure Expansion: Investment in regional industrial composting facilities will grow, complemented by decentralized composting solutions, making proper disposal of compostable materials more accessible and economically viable across diverse geographies.

These trends will reshape supply chains and offer new avenues for businesses committed to genuine environmental leadership.

Future trends in sustainable straws include truly degradable materials, AI-driven innovation, enhanced performance, and circular economy integration.

Competitive Advantage & Business Case

For B2B decision-makers, the transition to genuinely compostable straws is not merely a cost center; it is a strategic investment that delivers tangible competitive advantages and a compelling business case.

Quantifiable Impact:

- Risikominderung: By aligning with rigorous certifications (e.g., BPI, EN 13432) and ensuring proper disposal, businesses can virtually eliminate the risk of non-compliance with evolving single-use plastic bans, avoiding hefty fines and legal complications. Proactive compliance future-proofs your operations in a tightening regulatory landscape.

- Steigerung des Markenwerts: Adopting certified, truly compostable solutions significantly enhances your brand’s reputation as an environmental steward. This resonates deeply with the over 70% of consumers who prioritize eco-friendly businesses, translating into increased customer loyalty and a willingness to pay a premium for your products or services.

- Chance auf Marktanteile: As the global eco-friendly straws market approaches $25.1 billion by 2035, early and authentic adoption allows businesses to capture a larger share of this expanding segment. By appealing to environmentally conscious consumers and partnering with like-minded suppliers, companies can outpace competitors clinging to outdated, non-compliant solutions.

- Operational Efficiency through Reduced Waste: While initial costs might be higher, efficient waste management systems for compostable materials can lead to long-term cost savings by diverting waste from landfills, potentially reducing landfill fees and streamlining waste streams.

- Investor Appeal: Strong ESG (Environmental, Social, and Governance) performance, driven by verifiable sustainability initiatives, increasingly attracts socially responsible investors. Demonstrating a clear commitment to genuine compostability can improve your company’s investment profile and access to capital.

By meticulously evaluating and investing in truly compostable alternatives, your business transcends mere compliance, unlocking substantial market share, fortifying brand equity, and securing a sustainable, profitable future.

Investing in truly compostable straws offers B2B businesses risk mitigation, brand uplift, market share growth, and investor appeal.

Abschluss

PLA straws represent a meaningful step forward in sustainable packaging innovation. However, their true compostability is intricately tied to very specific industrial conditions and a robust infrastructure that, for the most part, remains significantly underdeveloped. For discerning B2B decision-makers—procurement managers, operations directors, and sustainability officers—navigating this complexity requires far more than good intentions. It demands rigorous due diligence, a strategic approach to waste management, and an unwavering commitment to transparent, verifiable sustainability. By understanding the critical distinctions between materials and exploring genuinely versatile alternatives like PHA, your business can confidently transition towards a future of authentic environmental responsibility, simultaneously enhancing operational efficiency and solidifying your brand’s reputation as a leader in eco-conscious practices.

Act now to secure your supply chain’s sustainable future; consult with certified compostable straw suppliers and assess your waste management strategy today to ensure genuine environmental impact!

Genuine compostability requires rigorous due diligence and strategic waste management for B2B businesses to achieve true environmental responsibility.

Häufig gestellte Fragen (FAQs)

Q: Do PLA straws truly break down in a typical hotel or restaurant’s waste bin?

A: No, PLA straws require specific industrial composting facilities with sustained high temperatures (above 140°F) to break down effectively. They will not decompose in standard landfill conditions or typical commercial waste bins, behaving much like traditional plastics.

Q: Can PLA straws contaminate my existing recycling streams in a foodservice operation?

A: Yes, absolutely. PLA has a lower melting point than common plastics like PET or HDPE. If PLA straws are mixed into your plastic recycling, they can contaminate the entire batch, rendering it unusable for recycling and diverting it to a landfill.

Q: What certifications should procurement managers look for when sourcing compostable straws for their B2B needs?

A: Procurement managers should prioritize straws certified by reputable organizations like BPI (Biodegradable Products Institute) in North America or TÜV Austria’s “OK compost INDUSTRIAL.” These certifications ensure the product meets stringent industrial compostability standards like ASTM D6400 or EN 13432.

Q: Are there truly compostable straw alternatives that don’t rely on industrial composting facilities?

A: Yes, PHA (Polyhydroxyalkanoate) straws are a next-generation bioplastic that can break down in a wider range of environments, including home composting and marine settings. Other options like sugarcane bagasse straws also offer broader compostability profiles.

Q: How can a hospitality business ensure proper disposal of PLA straws if industrial composting isn’t readily available locally?

A: If industrial composting is unavailable, consider transitioning to alternatives like PHA straws that offer home or marine compostability. Alternatively, partner with specialized waste management companies that can transport bioplastics to appropriate facilities, or explore local initiatives for composting infrastructure development.