The global business landscape is undergoing a profound transformation, driven by an urgent imperative for environmental stewardship. For procurement managers, operations directors, sustainability officers, and supply chain executives in the **hospitality & foodservice industries**, the choice of seemingly minor items, such as drinking straws, now carries significant strategic weight. Non-compliance with evolving sustainability mandates and a failure to meet shifting consumer expectations can lead to substantial operational and commercial repercussions, including regulatory fines, diminished brand value, and erosion of market share.

The Imperative for Sustainable Straws: Navigating Global Regulations & Market Shifts

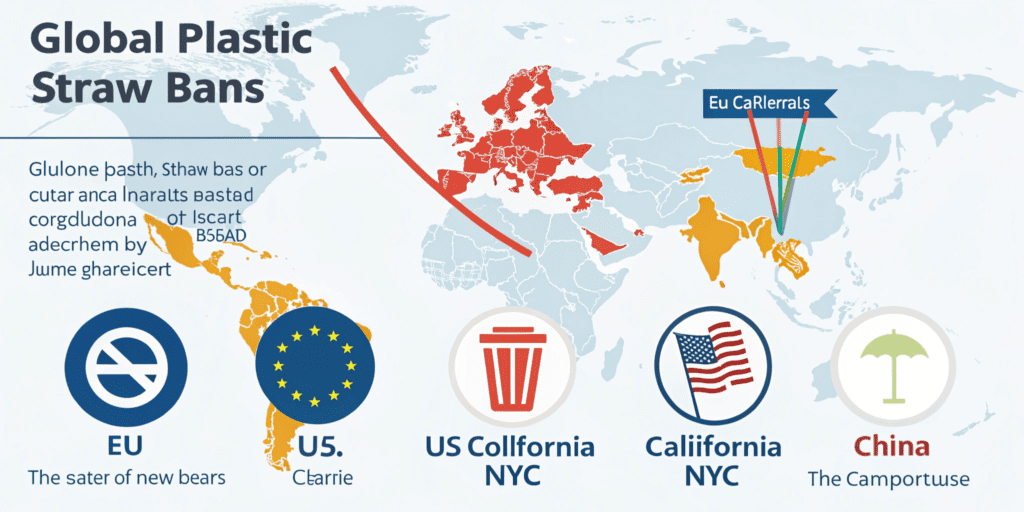

L’era della plastica monouso senza restrizioni si sta rapidamente concludendo, spinta da una spinta legislativa globale. La **Direttiva UE sui prodotti in plastica 2019** ha notoriamente vietato le cannucce di plastica monouso e una serie di altri articoli, a partire dal 3 luglio 2021, costringendo le aziende che operano all'interno dell'Unione Europea a cambiare rapidamente direzione. Il Regno Unito ha seguito l’esempio, attuando il proprio divieto sulla plastica monouso a partire dall’ottobre 2023. Dall’altra parte dell’Atlantico, il panorama normativo, sebbene frammentato, ha lo stesso impatto; a partire da marzo 2025, 19 stati e territori degli Stati Uniti hanno divieti a livello giurisdizionale su una o più materie plastiche monouso, con il Dipartimento degli Interni degli Stati Uniti che prevede di eliminare gradualmente i prodotti di plastica monouso dai parchi nazionali e dai terreni pubblici entro il 2032. Per qualsiasi impresa con un'impronta globale o operazioni regionali, la conformità normativa è diventata un fattore non negoziabile nella strategia di approvvigionamento, incidendo direttamente sull'accesso al mercato e sulla continuità operativa.

Questa pressione normativa è amplificata dalle avvincenti dinamiche di mercato. Si prevede che il mercato globale delle cannucce ecologiche raggiungerà quasi 25,1 miliardi di dollari entro il 2035, crescendo a un robusto tasso di crescita annuale composto (CAGR) del 7,3% rispetto a 12,3 miliardi di dollari stimati nel 2025. Più specificamente, il mercato delle cannucce biodegradabili è stato valutato a 40,367 miliardi di dollari nel 2024 e si prevede che salirà alle stelle fino a 204,167 miliardi di dollari entro il 2035. 2031, in dimostrazione un impressionante CAGR del 22,46%. Questa crescita esplosiva è una risposta diretta al sentimento dei consumatori; circa il 70% dei consumatori ora preferisce le aziende che utilizzano attivamente opzioni ecocompatibili. Ignorare questa duplice pressione – applicazione delle normative e crescente domanda dei consumatori – non è più un’opzione praticabile per le organizzazioni lungimiranti. Espone le aziende a rischi di conformità, complica gli approvvigionamenti e ha un impatto negativo sulla percezione dei clienti, erodendo in definitiva il vantaggio competitivo.Le aziende lungimiranti del settore alberghiero e della ristorazione devono adottare cannucce sostenibili per garantire la conformità e soddisfare la domanda dei consumatori.

Approfondimento: Cannucce di canna da zucchero: il vantaggio dei rifiuti agricoli

Le cannucce di canna da zucchero rappresentano un significativo passo avanti nella scienza dei materiali sostenibili. A differenza della plastica tradizionale, queste cannucce sono realizzate in bagassa, il sottoprodotto fibroso che rimane dopo l'estrazione del succo della canna da zucchero. Questo approccio innovativo ripropone i rifiuti agricoli, trasformando una potenziale sfida di smaltimento in una risorsa preziosa e rinnovabile.

Le cannucce di canna da zucchero sono al 100% di origine vegetale, il che le rende completamente biodegradabili e compostabili. I prodotti principali in genere si decompongono entro 90-180 giorni negli impianti di compostaggio commerciali, con alcune varianti certificate anche per il compostaggio domestico, offrendo un ciclo di fine vita ancora più snello. Dal punto di vista delle prestazioni, si distinguono per la loro durata e flessibilità, resistendo all'umidità anche se immersi in liquidi caldi fino a 220 ° F (104 ° C). Questa resilienza garantisce un'esperienza utente coerente e di alta qualità, un fattore critico per le **operazioni di ristorazione e ospitalità** che mirano a evitare i reclami di “paglia fradicia” associati alle precedenti alternative cartacee. Fondamentalmente, le rinomate cannucce di canna da zucchero sono naturalmente insapori, non tossiche e esplicitamente prive di sostanze chimiche dannose come BPA e PFAS (sostanze per e polifluoroalchiliche), salvaguardando sia la salute dei consumatori che l'integrità del marchio.

For procurement professionals, certifications are paramount to validate sustainability claims. Leading sugarcane straws hold a suite of certifications that attest to their environmental and safety credentials. These include BPI Industrial, TUV OK Compost Home, and US FDA Approval. Furthermore, many are certified Fluorine-Free, 5 Plastics Free (meaning no PP, PE, PS, PVC, PET), and PFAS-Free, offering robust assurance against “forever chemicals.” Compliance with global compostability standards such as AS5810 (home) and AS4736 (commercial) is a key indicator of genuine environmental impact. Understanding these certifications is vital for making truly sustainable procurement choices. To explore further details on how these innovative solutions are shaping the future of sustainable foodservice, read more onsugarcane straws and the sustainable foodservice future.

Real-World Impact: A Sugarcane Straw Case Study

The transition to sustainable alternatives often comes with perceived challenges, yet real-world applications demonstrate significant benefits. Strwd, a prominent sustainable straw provider, offers a compelling case in point. In its inaugural year, Strwd successfully replaced over 500,000 paper straws with sugarcane alternatives across 60 sites. This initiative not only led to a substantial reduction in plastic waste but also proved the operational viability and superior performance of sugarcane straws in a high-volume commercial environment. Such transitions underscore the potential for businesses to achieve significant environmental impact without compromising operational efficiency or customer satisfaction.Sugarcane straws offer a durable, compostable, and PFAS-free solution, ideal for high-volume hospitality and foodservice.

Deep Dive: Bamboo Straws – The Reusable, Natural Choice

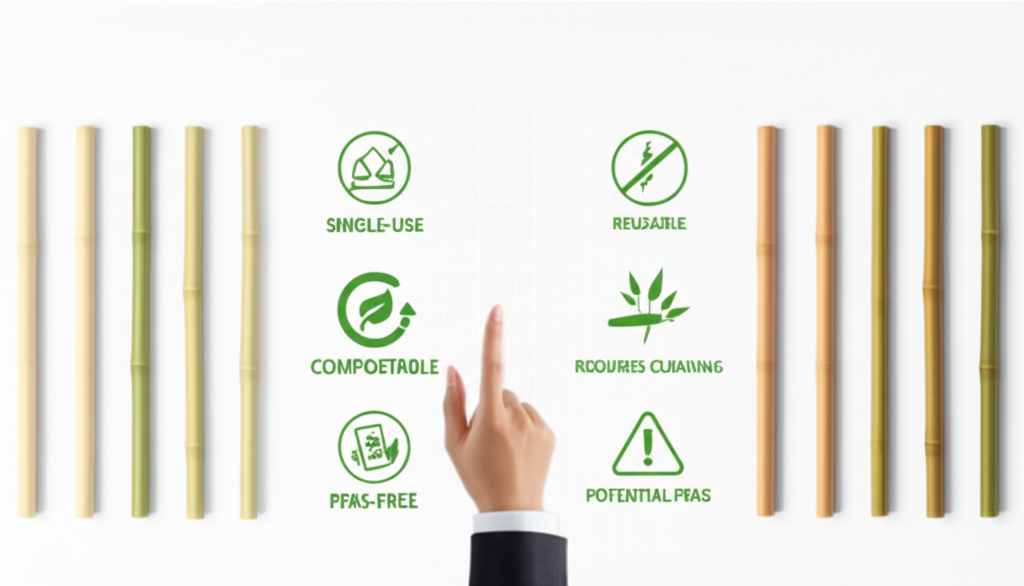

Bamboo straws, crafted from whole bamboo stalks, represent another compelling sustainable alternative. Bamboo is celebrated as a rapidly renewable resource, requiring minimal water and no pesticides for cultivation, making it an inherently eco-friendly material. A primary advantage of bamboo straws lies in their durability and design for reusability; with proper care, these straws can last for years, offering a truly long-term solution to single-use waste. Beyond their functional benefits, bamboo straws offer a unique, rustic, and natural aesthetic, appealing strongly to eco-conscious brands and consumers seeking an organic touch.

However, the procurement of bamboo straws necessitates a careful consideration of their challenges, particularly concerning hygiene and potential PFAS contamination. A concerning Belgian study revealed the presence of PFAS in 80% of bamboo straw brands tested, raising significant red flags about these “forever chemicals.” This finding complicates the narrative of bamboo as a universally safe and green option, demanding rigorous supplier vetting.

Furthermore, the porous nature of bamboo necessitates diligent cleaning with a dedicated brush and thorough drying to prevent mold and bacterial growth, a critical operational consideration for businesses. In commercial settings, where rigorous cleaning protocols are essential, their practical lifespan can be shorter than expected, often ranging from 2-3 months. This shorter commercial lifespan can lead to a higher annual cost, with one analysis citing an annual cost of €7.97 per straw, potentially making them less cost-effective than some single-use alternatives in high-turnover environments. Some users also report a mild, natural “woody” taste transfer to beverages, which, while subtle, can impact the customer experience for delicate drinks.Bamboo straws offer reusability and natural aesthetics but require careful hygiene and vetting for PFAS contamination.

Procurement Insights: Sugarcane vs. Bamboo – A Strategic Comparison

Choosing between sugarcane and bamboo straws requires a nuanced, data-driven approach tailored to a business’s specific operational needs and sustainability goals. Each material presents distinct advantages and drawbacks, and the optimal choice often hinges on factors such as intended use, disposal capabilities, and desired brand image.

Feature-by-Feature: B2B Operational Impact & ROI Potential

| Caratteristica | Impatto operativo B2B | Nota di conformità | Potenziale ROI |

|---|---|---|---|

| Materiale | Sugarcane fiber/bagasse (repurposed agri-waste) vs. Whole bamboo stalks (rapidly renewable resource). Sugarcane production repurposes agricultural waste, aiding circular economy models. Bamboo offers a natural, often handcrafted appeal. | Both support plastic ban compliance (e.g., EU SUPD, UK ban, US state-level restrictions). Ensure third-party certifications (e.g., BPI for sugarcane, FSC for bamboo sourcing). | Reduced plastic waste disposal fees; enhanced brand image as an eco-conscious leader. |

| Reusability | Sugarcane: Primarily single-use, eliminating labor-intensive cleaning and storage for high-volume operations. Bamboo: Designed for reusability, requiring robust cleaning protocols and dedicated staff training for hygiene. | Sugarcane: Simplifies adherence to single-use regulations while ensuring compostability. Bamboo: Requires adherence to strict hygiene and sanitation standards for reuse. | Sugarcane: Lower direct operational costs (no cleaning labor, no re-stocking of individual clean straws). Bamboo: Lower per-use cost over very long term *if* meticulously managed and re-used hundreds of times. |

| Durabilità | Sugarcane: Resists sogginess and maintains integrity across temperatures (up to 220°F/104°C), performing consistently like plastic without environmental harm. Bamboo: Sturdy, but can crack/splinter with frequent commercial use and is less consistent than manufactured products. | Sugarcane: Consistent performance minimizes customer complaints and waste from failed straws, supporting compliance with quality standards. Bamboo: Requires quality control to prevent issues that could lead to consumer dissatisfaction or waste. | Sugarcane: Higher customer satisfaction due to consistent, reliable performance; fewer re-servings; reduced waste from prematurely discarded straws. Bamboo: Longevity requires meticulous care, potentially offsetting some durability advantages in busy commercial settings. |

| Gusto/Odore | Sugarcane: Neutral taste, ensuring no alteration to beverage flavor. Vital for high-end beverages or sensitive customer palates. Bamboo: Mild natural taste, can subtly affect delicate flavors, a potential concern for gourmet beverage offerings. | Both can align with food safety standards if properly manufactured and cleaned (for bamboo). | Sugarcane: Higher customer satisfaction and brand reputation due to superior taste neutrality. Minimizes complaints or re-servings based on taste impact. |

| Disposal | Sugarcane: Commercial & home compostable (2-4 months); transforms into nutrient-rich soil. Offers a clear, eco-friendly end-of-life solution reducing landfill burden. Bamboo: Biodegradable, but may require industrial composting for efficient breakdown; slower decomposition than sugarcane. | Sugarcane: Meets stringent compostability certifications (AS5810, AS4736, TUV OK Compost). Bamboo: Biodegradability varies; requires careful consideration of local composting infrastructure to ensure proper disposal. | Sugarcane: Easier, faster end-of-life cycle; reduces landfill burden and associated waste disposal fees; enhances circular economy credentials. Bamboo: If not properly composted, can still contribute to landfill issues. |

| Cost (Unit/Upfront) | Sugarcane: More affordable in bulk per unit, ideal for high-volume, single-use environments. A plant-based PLA straw (similar category) costs ~$0.24 compared to ~$0.052 for plastic. Bamboo: Higher initial cost due to handcrafted production, but reusable over time. | Cost-effectiveness needs to align with budget and waste reduction goals. | Sugarcane: Suitable for high-volume, quick-turnover environments; lower initial investment for large-scale adoption. Bamboo: Higher initial outlay; long-term savings for consistent, disciplined reuse. |

| PFAS Risk | Sugarcane: Leading brands claim PFAS-free and are certified Fluorine-Free. Crucial for mitigating regulatory and reputational risk. Bamboo: Belgian study found PFAS in 80% of brands tested, raising significant concern about “forever chemicals.” | Sugarcane: Compliance with emerging PFAS regulations and consumer safety expectations. Bamboo: Requires rigorous vetting to ensure PFAS-free certification, or risk significant compliance and reputational damage. | Sugarcane: Mitigates regulatory/reputational risk from PFAS contamination, enhancing consumer trust and market access. Bamboo: Potential for PFAS exposure could lead to product recalls, fines, and severe brand erosion. |

For a more comprehensive guide on procurement for sustainable hospitality, including bamboo and sugarcane options, refer to ourbamboo sugarcane sustainable hospitality procurement guide.Strategic procurement of sustainable straws requires evaluating material, reusability, durability, taste, disposal, cost, and PFAS risk.

Overcoming Adoption Barriers in Sustainable Straw Procurement

Despite the clear environmental and ethical drivers, several barriers can impede the widespread adoption of sustainable straws in B2B settings. One significant hurdle is the perception of higher procurement costs. Indeed, while single-use plastic straws might cost around $0.052, a plant-based alternative, like a PLA straw, can be approximately $0.24—a substantial difference for high-volume operations. This cost disparity demands a shift in perspective from unit price to total cost of ownership, factoring in environmental impact, brand value, and regulatory compliance.

Customer experience is another critical consideration. Early iterations of paper straws, for example, often suffered from the “soggy straw” phenomenon, leading one major Quick Service Restaurant (QSR) chain to experience a 15% decrease in positive beverage reviews after switching. This highlights the importance of selecting high-performance sustainable alternatives that do not compromise the end-user experience.

Furthermore, the complexities surrounding disposal can create confusion and undermine environmental efforts. Many “compostable” options, like PLA, require specific industrial composting facilities to break down effectively. With only approximately 15% of U.S. composting facilities accepting bioplastics, many such items still end up in landfills, where they can take centuries to decompose and may even release potent greenhouse gases like methane. This underscores the need for clear communication and access to appropriate disposal infrastructure.

Navigating the supply chain for bio-based straws also presents complexities. While the global biodegradable straws market was valued at USD 41,521.6 million in 2024, indicating robust supply, logistical challenges, such as long transport routes from Asia for some bamboo products, can impact overall carbon footprint and lead times. Continuous innovation, however, is focused on reducing production costs and enhancing product performance to overcome these operational and supply chain hurdles.Overcoming sustainable straw adoption barriers involves addressing cost perception, ensuring customer experience, and clarifying disposal complexities.

Future Outlook: Innovations and Policy in the Sustainable Straw Market

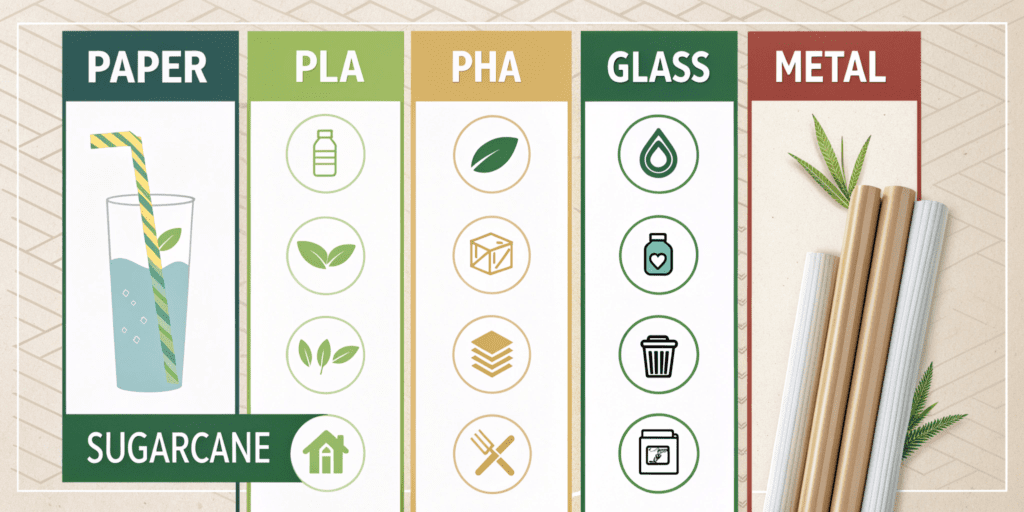

The journey of drinking straws has been a long one, from Sumerian gold tubes in 3000 BCE to rye grass, then plastic, and now, a diverse array of sustainable materials. The future of the sustainable straw market is marked by relentless innovation and evolving policy landscapes. We are witnessing the emergence of truly novel solutions, such as edible straws made from ingredients like wheat, rice, or pasta, offering a zero-waste solution. New bioplastics, including Polyhydroxyalkanoates (PHA), are also gaining traction, promising enhanced biodegradability and performance.

Experts project the eco-friendly straw market to grow from $1.8 billion in 2023 to $5.1 billion by 2030, according to the *Journal of Industrial Ecology*. This exponential growth will be fueled by continuous advancements in material science, leading to more durable, cost-effective, and truly compostable solutions. Regulatory bodies are expected to intensify their focus, not just on banning single-use plastics, but on scrutinizing the entire lifecycle of alternatives, particularly concerning PFAS and genuine biodegradability.

Procurement teams are uniquely positioned to act as catalysts for this greener supply chain. By proactively seeking and demanding truly sustainable materials, they can drive innovation and adoption throughout the industry. While plastic straw bans represent a tiny fraction (less than 1%) of overall plastic pollution, they serve as a critical entry point for businesses to engage with broader sustainability initiatives and reduce their environmental footprint. Strategic procurement of eco-friendly products like sugarcane straws fosters a positive cycle of demand and innovation, pushing the entire market towards more sustainable practices. Read more about how procurement can drive sustainability in hospitality by reviewing this resource onsustainable straws in hospitality.The sustainable straw market is rapidly evolving with innovations and policies driving demand for truly eco-friendly solutions.

Competitive Advantage & Business Case

For B2B decision-makers, the shift to sustainable straws is more than just compliance; it’s a profound opportunity to establish a competitive advantage and bolster the business case for environmental responsibility. Quantifiable benefits include:

- Risparmio sui costi: While initial unit costs may be higher, adopting genuinely compostable solutions like sugarcane straws can lead to significant long-term cost savings by reducing waste disposal fees, which are increasingly tied to volume and type of waste. Avoiding regulatory fines for non-compliance further safeguards profitability.

- Risk Mitigation: Proactively transitioning to PFAS-free and fully certified compostable straws insulates your brand from future regulatory crackdowns and potential litigation related to environmental and health concerns. This foresight minimizes operational disruptions and protects against reputational damage.

- Brand Value Uplift: In an era where consumers and corporate partners prioritize sustainability, a demonstrable commitment to eco-friendly practices enhances brand perception, attracts a growing segment of environmentally conscious customers, and improves employee morale and retention. This can translate directly into increased market share and stronger customer loyalty.

- Opportunità di quota di mercato: By leading the charge in sustainable procurement, businesses can differentiate themselves in a crowded market. This positions them as innovators and responsible corporate citizens, opening doors to new partnerships, tenders, and customer segments that value environmental alignment. The projected multi-billion dollar growth in the eco-friendly straw market signals a clear opportunity for market leadership for those who act decisively.

Adopting sustainable straws offers significant competitive advantages, including cost savings, risk mitigation, and enhanced brand value.

Conclusione

Choosing between sugarcane and bamboo **drinking straws** requires a nuanced **procurement guide** approach, weighing operational demands against unwavering environmental commitments. **Sugarcane straws** offer a reliable, compostable single-use solution, minimizing hygiene concerns and simplifying disposal for high-volume settings, while explicitly avoiding PFAS and repurposing agricultural waste. **Bamboo straws** excel in reusability and natural aesthetics, ideal for lower-volume applications where cleaning protocols can be meticulously managed, despite potential PFAS concerns and shorter commercial lifespans in demanding environments.

The market is clearly moving towards sustainable alternatives, driven by both legislation and consumer demand. Embrace this shift now. Request a comprehensive sample pack of certified PFAS-free sugarcane straw varieties today to assess their superior performance and secure your supply chain before regulatory pressures tighten further and competitors seize market advantage.Request a Sample Pack Today

Domande frequenti

Q: Why should hospitality businesses switch to sugarcane straws?

A: Sugarcane straws offer superior durability, remain taste-neutral, are 100% compostable, and repurpose agricultural waste, enhancing your brand’s sustainability without compromising customer experience.

Q: Are sugarcane straws truly compostable in commercial settings?

A: Yes, leading sugarcane straws are certified for commercial composting (e.g., AS4736, BPI Industrial), breaking down within 90-180 days into nutrient-rich soil, reducing landfill burden.

Q: How do sugarcane straws compare to bamboo straws for hygiene in foodservice?

A: Sugarcane straws are single-use and non-porous, simplifying hygiene. Bamboo straws, while reusable, require meticulous cleaning and drying to prevent mold and bacterial growth, which can be challenging in high-volume foodservice.

Q: What are the cost implications of switching to sustainable straws for a large hotel chain?

A: While unit costs might be higher than plastic, sugarcane straws offer long-term savings by reducing waste disposal fees, avoiding regulatory fines, and boosting brand value, leading to increased customer loyalty and market share.

Q: Are sugarcane straws free from harmful chemicals like PFAS?

A: Yes, reputable sugarcane straw brands are certified PFAS-free and Fluorine-Free, ensuring consumer safety and mitigating regulatory and reputational risks for your business.