The global push for sustainability has positioned compostable materials as a seemingly straightforward alternative to traditional plastics, promising a greener future. Annual production of bioplastics is projected to grow significantly, yet for procurement managers, operations directors, and supply chain executives in the hospitality & foodservice industries, a deeper, more critical understanding of their less-publicized drawbacks is crucial. Ignoring these complexities can lead to unforeseen operational hurdles, inflated costs, and even unintended environmental consequences, undermining genuine sustainability efforts. This article unmasks the often-overlooked financial, operational, and environmental complexities inherent in compostable solutions, enabling informed decision-making for truly sustainable B2B practices.

Sources: European Bioplastics (2023), U.S. Composting Council (2023), Ellen MacArthur Foundation (2022).

Understanding compostable material disadvantages is vital for hospitality and foodservice to avoid hidden costs and environmental pitfalls.

The Financial Disadvantages of Compostable Solutions for B2B

While the environmental intent behind compostable materials is commendable, their economic realities often present significant challenges for businesses. These challenges extend beyond initial procurement, impacting overall operational budgets and long-term financial viability.

Higher Procurement and Production Costs

Compostable products are consistently more expensive than their traditional plastic counterparts. This cost disparity stems from several factors:

- Raw Material Premium: Unlike fossil fuel-derived plastics, compostables often rely on plant-based feedstocks (e.g., corn starch, sugarcane), which can have higher cultivation, harvesting, and processing costs. This inflates the base price of raw materials, directly impacting procurement expenses for B2B buyers.

- Complex Manufacturing: The production processes for bioplastics and compostable materials are often more resource-intensive and complicated. Specialized machinery, tighter process controls, and lower production yields contribute to higher unit costs.

- Compliance and Certification Burdens: Achieving certifications like EN 13432 for industrial composting or BPI Compostable Certification requires rigorous testing and ongoing compliance audits. These add further financial burdens for manufacturers, which are inevitably passed down to businesses purchasing these products. The lack of standardized federal regulation in some regions means businesses must often navigate a patchwork of certifications, increasing due diligence costs.

Limited Durability and Increased Replacement Rates

One of the inherent trade-offs with many compostable materials is their designed biodegradability, which often comes at the expense of durability.

- Reduced Tensile Strength: Research indicates that many compostables possess lower tensile strength compared to conventional plastics. This makes them more susceptible to tearing, puncturing, and premature degradation, particularly in applications requiring robust, long-term material integrity. For hospitality operations involving handling, transport, or extended use, this can be a critical limitation.

- Shorter Shelf Life: Designed to break down, compostable products typically have a shorter shelf life (e.g., around 9 months if stored correctly) and require specific storage conditions, such as cool, dry environments away from direct sunlight and humidity. Failure to adhere to these requirements can result in premature degradation before even being used, leading to increased spoilage and waste.

- Higher Operational Expenses: The combined effect of lower durability and shorter shelf life necessitates more frequent replacement of products. For businesses operating at scale, this translates directly into higher operational expenses, negating potential savings from other sustainability initiatives and impacting the total cost of ownership.

Higher costs and reduced durability of compostables significantly impact B2B operational budgets.

Operational Hurdles: Navigating the Disadvantages of Compostable Disposal

The true environmental benefit of compostable materials hinges entirely on their proper end-of-life management. However, for most businesses, this presents significant operational hurdles that often lead to unintended consequences.

Scarce Industrial Composting Infrastructure

The vast majority of certified compostable products require very specific conditions—high temperatures, controlled moisture levels, and the presence of specialized microorganisms—found only in industrial composting facilities.

- Limited Availability: In the U.S. and many parts of Europe, these industrial composting facilities are not widely available. Many U.S. communities lack access to commercial composting, and a significant majority of U.S. commercial and municipal composters do not accept compostable packaging or foodware. This infrastructure gap means that even genuinely certified compostable products frequently end up in landfills or incinerators.

- Logistical Challenges: For foodservice businesses, this scarcity translates into complex and often costly logistics for proper disposal. Without accessible local industrial composting, companies may face high transportation costs to distant facilities or simply have no viable avenue for diverting these materials from landfill, negating their “compostable” advantage.

Contamination Risks for Recycling and Composting Streams

A critical operational challenge lies in the visual similarity of compostable products to traditional plastics and paper, leading to widespread consumer and operational confusion.

- Recycling Contamination: Compostables are frequently mistaken for recyclables and incorrectly placed in traditional recycling bins. Since standard recycling systems are not equipped to process these materials, they become contaminants, reducing the quality and value of recyclable waste streams and increasing sorting costs for waste management facilities and, ultimately, taxpayers.

- Compost Stream Contamination: Even within composting streams, contamination is a significant issue. Non-compostable items (e.g., conventional plastics, glass, produce stickers, or non-compostable labels) can easily be mixed into compost piles. This cross-contamination can decrease the quality of the finished compost, making it less valuable for agricultural or landscaping applications. Concerns over unknown chemical additives, such as PFAS, also make commercial composters reluctant to accept certain bioplastics.

Methane Emissions in Landfills: A Hidden Carbon Footprint

The primary environmental benefit of compostable materials is realized only when they are properly composted. If, due to infrastructure limitations or improper disposal, compostable products end up in landfills, their environmental impact can be counterproductive.

- Anaerobic Decomposition: Landfills are typically anaerobic environments, meaning they lack the oxygen necessary for compostable materials to break down effectively into beneficial compost. Instead, they decompose without oxygen, producing methane gas.

- Potent Greenhouse Gas: Methane (CH4) is a potent greenhouse gas, far more impactful than carbon dioxide over shorter timeframes. It is approximately 23 to 30 times more powerful than carbon dioxide over a 100-year period. Therefore, compostable materials contributing to methane emissions in landfills represent a significant, often hidden, carbon footprint that undermines their perceived environmental benefits. It’s also important to note that certain anaerobic composting systems, if not properly managed, can also produce comparable methane levels to landfills.

Disposal challenges, contamination, and methane risks undermine compostables’ environmental promise for B2B.

Environmental and Regulatory Disadvantages of Compostable Materials

Beyond operational and financial hurdles, compostable materials present distinct environmental and regulatory challenges that demand scrutiny from B2B decision-makers.

Resource-Intensive Production and Carbon Footprint

While seemingly green, the production cycle of many bioplastics can be surprisingly resource-intensive.

- Agricultural Demands: Growing crops for bioplastics (e.g., corn, sugarcane, potato starch) demands significant farmland, water, and often, fossil fuels for agricultural machinery, fertilizers, and pesticides. This can lead to competition with food production, putting pressure on land and water resources. The use of fertilizers and pesticides can also result in eutrophication of water bodies.

- Processing Emissions: The industrial processes required to convert plant matter into biopolymers also consume substantial energy, contributing to their overall carbon footprint. Some analyses suggest that the lifetime greenhouse gas emissions of certain compostable products can be comparable to, or even higher than, conventional plastics, especially when accounting for agricultural emissions and transportation.

Presence of PFAS and Other Toxic Additives

A significant and growing concern for B2B entities, particularly those infood service and packaging, is the presence of per- and polyfluoroalkyl substances (PFAS) in many molded fiber compostable products.

- “Forever Chemicals”: PFAS are known as “forever chemicals” due to their extreme persistence in the environment and are linked to a range of harmful health impacts, including cancer, immune system dysfunction, and developmental issues. They are often added to molded fiber products to provide water and grease resistance.

- Contamination Risk: When PFAS-containing compostable materials are processed, these chemicals can leach into the finished compost, contaminating soil and water systems. This poses a long-term environmental and public health risk, complicating the very purpose of composting. As a result, many commercial composting facilities are increasingly reluctant to accept bioplastics due to concerns about PFAS contamination.

- Unstudied Toxicity: Beyond PFAS, bioplastics are manufactured using processes similar to traditional plastics and may contain other chemical additives (e.g., plasticizers, stabilizers, colorants) whose long-term environmental and health impacts are less studied or unknown compared to conventional plastic additives.

Lack of Standardized Regulation and Consumer Confusion

The regulatory landscape surrounding “compostable” products remains fragmented and often inadequate, leading to significant market confusion.

- Federal Standards Void: In many regions, including the U.S., there is a critical absence of clear federal standards defining or regulating “bioplastic,” “biodegradable,” or “compostable” products. This regulatory void allows manufacturers to label products without meeting specific, universally accepted criteria, leading to greenwashing and misleading claims.

- Consumer Misconceptions: This lack of clear guidance, combined with products often designed to resemble recyclables, creates widespread confusion among consumers. Unclear disposal instructions exacerbate the problem, leading to incorrect disposal in recycling bins or landfills, undermining the product’s intended environmental pathway. This regulatory uncertainty also hampers effective end-of-life management and erodes stakeholder confidence in the genuine sustainability claims of these materials.

Microplastic Formation: A Hidden Bioplastic Drawback

While advertised as fully degradable, not all bioplastics decompose completely or benignly in natural environments.

- Incomplete Degradation: Many compostable plastics require specific conditions (high temperature, humidity) found only in industrial composting facilities to break down properly. If these conditions are not met, such as in home compost piles or if littered in natural settings like soil or water, they may persist for extended periods, similar to conventional plastics.

- Accumulation in Soil: As bioplastics degrade, particularly in suboptimal conditions, they may break down into harmful microplastics rather than fully disappearing into organic matter, water, and CO2. These microplastics can accumulate in soil, affecting agricultural productivity and leading to long-term contamination.

- Ecosystem Impact: Microplastics can interfere with soil structure, altering porosity and water-holding capacity, and negatively affecting plant root systems and beneficial microbial communities essential for soil health and fertility. They can also adversely affect soil organisms like earthworms.

Compostables face environmental concerns like resource-intensive production, PFAS, and microplastic formation.

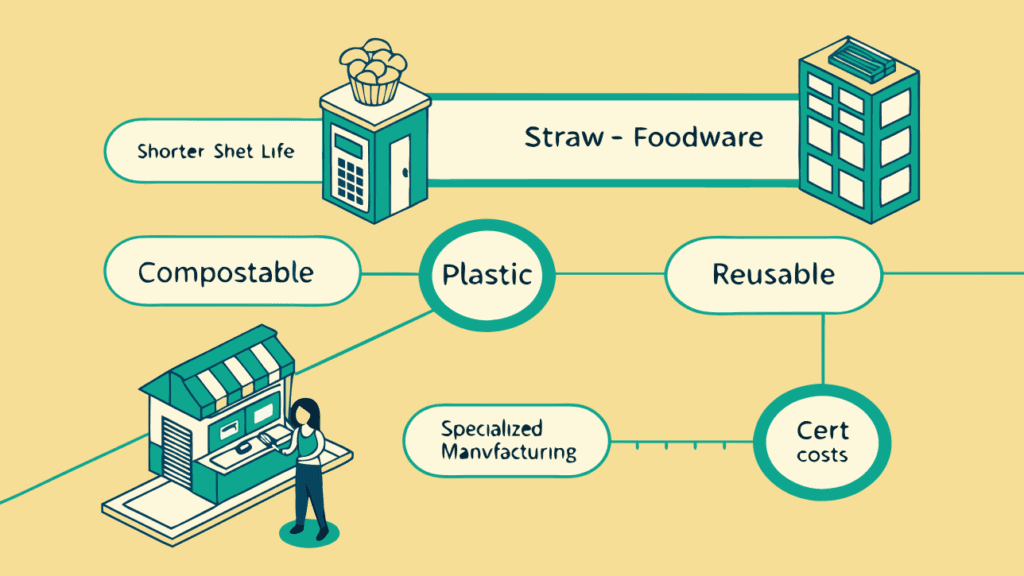

Comparison: Compostable vs. Other Material Options

For B2B decision-makers, evaluating material choices requires a comprehensive understanding of their respective impacts. The following table provides a comparison of compostable products against other common material options:

| Besonderheit | B2B Betriebswirkung | Compliance Note | ROI -Potenzial |

|---|---|---|---|

| Compostable Products | Higher procurement, shorter shelf life, limited durability, complex disposal logistics due to scarce infrastructure. | Requires specific industrial composting certification (e.g., EN 13432). High risk of regulatory confusion without clear federal standards. Potential PFAS content is a growing compliance concern. | Lower direct ROI due to higher costs, limited end-of-life value (not reused in new products). Reputational gains for sustainability, but often unfulfilled if proper disposal isn’t achieved. |

| Traditional Plastics | Lower upfront cost, high durability, established supply chains, long shelf life. Significant supply chain flexibility. | Subject to increasing plastic bans/taxes, Extended Producer Responsibility (EPR) schemes in many regions (e.g., EU). Growing public pressure for recycling/reduction. | Higher short-term cost-efficiency. Long-term risks from regulation, potential brand damage due to environmental perception, and reliance on a linear waste model. |

| Recyclable Materials | Requires robust sorting infrastructure, clean streams, material-specific handling. Can reduce virgin material dependency. | Adherence to local recycling guidelines, which vary widely. Potential for EPR compliance incentives. Must navigate global market fluctuations for recycled content. | Variable ROI, dependent on market value of recyclables and efficiency of collection/processing. Supports circular economy models, potentially reducing virgin material costs and demonstrating environmental responsibility. |

| Reusable Systems | High initial investment for infrastructure (e.g., washing, sterilization, return logistics). Requires robust collection, sanitization, and tracking. | Compliance with stringent hygiene/safety standards (e.g., food service). Developing regulatory frameworks for reuse targets and deposit-return schemes. | Significant long-term ROI through reduced waste generation, lower per-use cost over time, enhanced brand perception, and strong alignment with circular economy principles. Potential for new revenue streams. |

Comparing materials reveals compostables’ unique operational, compliance, and ROI challenges for B2B.

Mini Case Study: The Municipal Composting Bottleneck: A Compostable Packaging Challenge

Recent reports, notably from organizations likeBeyond Plastics, highlight a growing reluctance among commercial and municipal composting facilities to accept “compostable” foodware and packaging. This operational reality exposes a critical flaw in the widespread adoption of compostable materials for B2B use.

A key reason for this reluctance is the persistent problem ofcontamination. Compostable products, often visually indistinguishable from conventional plastics, are frequently mis-sorted by consumers or employees, leading to non-compostable items entering the composting stream. Furthermore, concerns over undisclosed chemical additives, such as PFAS, have made composters wary, as these “forever chemicals” can persist in the finished compost, rendering it unusable or undesirable for agricultural applications. The volume of compostable items produced byhospitality institutionsalso often exceeds the volume of nutrient-rich food waste that composters prioritize, further reducing their value proposition for these facilities.

For many B2B entities, this means that even if they procure certified compostable products with the best intentions, the lack of viable local processing infrastructure often forces these materials into landfills. This undermines the environmental benefits sought, leading to wasted investment in materials that cannot be properly diverted and may even produce harmful methane emissions in landfills. It also risks accusations of “greenwashing” if the end-of-life promise cannot be fulfilled. Businesses must evaluate not just if a product is certified compostable, but whether their local waste management ecosystem can actually process it as such.

Composting bottlenecks and contamination risks mean many compostables still end up in landfills.

Future Trends & Innovation in Sustainable Materials

Looking ahead 5–10 years, the challenges associated with compostable materials will drive significant innovation and regulatory shifts. For procurement and operations leaders, anticipating these trends is key to developing resilient, truly sustainable supply chains.

- Stricter Certification and Labeling Standards: Expect a global push for more harmonized and rigorous federal standards for “compostable” and “biodegradable” labels. The current confusion will likely necessitate clearer, legally binding definitions that specify degradation conditions (e.g., industrial vs. home compost), timelines, and verified absence of harmful chemicals. This will reduce greenwashing and improve consumer and business confidence. Organizations like BPI Compostable Certification are already pushing for greater clarity.

- Advanced Composting Infrastructure: The current bottleneck in industrial composting facilities will likely spur investment in scaling up infrastructure, particularly in urban and commercial centers. Innovations in anaerobic digestion and decentralized composting technologies may become more prevalent, aiming to process organic waste more efficiently and capture biogas.

- PFAS-Free Mandates and Material Science: Regulatory pressure on PFAS will intensify, with more jurisdictions implementing bans on their use in food packaging. This will accelerate research and development into truly safe, non-toxic barrier coatings and alternative materials that provide necessary functionality without hazardous chemicals. This aligns with a broader shift towards transparency regarding chemical additives.

- Emphasis on Circularity over Degradability: The focus will increasingly shift from “end-of-life degradation” to “resource circularity.” This means a greater emphasis on materials that can be genuinely recycled, reused, or upcycled, rather than simply breaking down into CO2 and water. Investments will flow into advanced recycling technologies for traditional plastics and bio-based plastics alike. Businesses will prioritize materials that can genuinely re-enter the value chain, minimizing waste and resource depletion.

- Rise of Truly Edible and Water-Soluble Solutions: Innovations in food-grade, edible materials (like certain edible compostable straws) and fully water-soluble films or coatings will gain traction as a “no-waste” solution, bypassing composting infrastructure limitations entirely. These solutions offer clear end-of-life pathways, either consumed or safely dissolved, eliminating disposal complexities.

- Bio-based, Non-Compostable Alternatives: A distinction will grow between compostable bioplastics and durable bio-based plastics designed for long-term use and recycling. Materials derived from renewable resources but engineered for performance and recyclability will gain prominence as a more “circular” alternative to single-use compostables.

- Data-Driven Waste Management: Businesses will increasingly leverage IoT and AI to optimize waste segregation, collection, and processing. Smart bins, real-time waste stream analysis, and predictive analytics will help improve diversion rates and reduce contamination, making existing composting and recycling infrastructure more effective.

Future trends emphasize stricter standards, circularity, and innovative, truly sustainable material solutions.

Competitive Advantage & Business Case

For forward-thinking B2B leaders, understanding and proactively addressing the disadvantages of compostable materials can be a powerful source of competitive advantage. This isn’t just about compliance; it’s about strategic positioning and long-term value creation.

- Quantifiable Cost Savings & Risk Mitigation: By recognizing the hidden costs of compostables (higher procurement, increased replacement rates, complex disposal logistics), businesses can pivot to solutions that offer genuine economic efficiency. This might involve investing in durable reusable systems with a high return on investment, or sourcing certified materials with a proven, accessible end-of-life pathway. Avoiding materials that often end up in landfills despite their “compostable” label mitigates the financial risk of wasted procurement spend and potential regulatory penalties for mismanaged waste. For example, replacing single-use compostables with robust, certified compostable straw materials that align with local infrastructure, or even edible alternatives, can lead to significant cost efficiencies.

- Enhanced Brand Value and Authenticity: Consumers and regulators are increasingly discerning, looking beyond surface-level “green” claims. Businesses that transparently address the complexities of material disposal and invest in truly circular or genuinely sustainable solutions—rather than just “compostable” products that end up in landfills—build stronger, more authentic brand credibility. This proactive approach cultivates trust, attracting environmentally conscious customers and talent, and protecting against “greenwashing” accusations. A brand known for genuinely impactful sustainability can command a market share premium and enjoy greater customer loyalty.

- Future-Proofing Compliance: The regulatory landscape for plastics and packaging is rapidly evolving, particularly in the EU with Extended Producer Responsibility (EPR) schemes and increasing bans on certain single-use plastics. By thoroughly understanding the true environmental pathways of materials, businesses can select options that are less likely to become obsolete due to future regulations (e.g., mandates for PFAS-free products or requirements for verifiable end-of-life solutions). This proactive compliance reduces future legal risks and operational disruptions. Focusing on certified compostable materials that adhere to standards like EN 13432 and understanding the nuances of BPI Compostable Certification can be a crucial part of this strategy.

- Operational Efficiency and Innovation: Challenging the assumption that compostable is always better forces a deeper dive into operational waste management. This can lead to process innovations, such as improved internal sorting, partnerships with specialized waste processors, or even the development of closed-loop systems. Streamlining waste management and reducing contamination not only saves costs but also demonstrates operational excellence, setting a business apart from competitors.

Proactively addressing compostable disadvantages offers B2B leaders competitive advantage through cost savings, brand value, and compliance.

Conclusion: Beyond the Green Veil: Strategic Considerations for B2B Leaders

While compostable materials offer a compelling sustainability narrative, their current operational, financial, and environmental disadvantages are substantial for B2B procurement and operations. Understanding the profound impact of scarce infrastructure, regulatory complexities, the risk of contamination, and true end-of-life viability is critical. Businesses must look beyond the initial “green promise” and conduct thorough due diligence on the entire lifecycle of a material, from sourcing to disposal. A holistic approach considering the entire supply chain impact is essential for achieving genuinely impactful sustainability goals, ensuring that investments in “eco-friendly” solutions deliver real-world benefits, not just marketing claims.

True sustainability requires B2B leaders to critically assess compostables’ full lifecycle impact.

Optimize Your Sustainable Sourcing Strategy.

Evaluate your current packaging and disposal practices against a comprehensive sustainability framework to identify viable, truly impactful alternatives and avoid unintended consequences.Request a consultation today to transform your supply chain into a competitive advantage.

Häufig gestellte Fragen

Why are compostable products often more expensive for B2B buyers?

Compostable products incur higher costs due to premium raw materials, complex manufacturing processes, and the financial burden of compliance and certification, all passed to buyers.

What are the main operational challenges of using compostable materials in hospitality?

Operational challenges include scarce industrial composting infrastructure, high contamination risks for recycling streams, and the potential for methane emissions if compostables end up in landfills.

Do compostable materials truly break down without harming the environment?

Compostable materials require specific industrial conditions to break down benignly; otherwise, they can persist, form microplastics, or produce methane in landfills.

How can procurement managers avoid ‘greenwashing’ with compostable products?

Procurement managers should verify certifications, assess local composting infrastructure, and prioritize materials with clear, verifiable end-of-life pathways to avoid greenwashing.

What are the alternatives to compostable materials for sustainable B2B operations?

Alternatives include genuinely recyclable materials, robust reusable systems, and innovative edible or water-soluble solutions, focusing on true circularity and reduced waste.