Kıdemli B2B Sürdürülebilirlik İçerik Stratejisti tarafından

Giriş: Konaklama Tedarik Zincirlerinin Değişen Kumları

Küresel plastik pipet yasakları, oteller ve kafeler için B2B ortamını hızla yeniden şekillendiriyor, satın alma stratejilerini ve operasyonel normları dönüştürüyor. Bu yalnızca çevresel bir eğilim değil; Bu, artan ekolojik kaygılar ve sürdürülebilirliğe yönelik aşırı tüketici talebinin yol açtığı temel bir düzenleme değişikliğidir. Tedarik yöneticileri, operasyon direktörleri ve sürdürülebilirlik görevlileri için uyumluluğun inceliklerini ve sürdürülebilir alternatiflerin uygulanabilirliğini anlamak artık isteğe bağlı değil; pazara erişim ve marka bütünlüğü için bir zorunluluktur.

Bu geçişin göz ardı edilmesi önemli operasyonel ve ticari riskler taşır. Uyum sağlamayan işletmeler potansiyel para cezalarıyla, itibar kaybıyla ve çevre bilincinin giderek arttığı bir pazarda müşteri sadakatinin erozyona uğramasıyla karşı karşıya kalıyor. Bu kılavuz, konaklama liderlerinin bu değişiklikleri stratejik olarak yönlendirmesine, uyumluluğu güvence altına almasına ve zorlukları rekabet avantajına dönüştürmesine yardımcı olacak temel, veriye dayalı bilgiler sağlar.

Plastik pipet yasaklarına proaktif uyum sağlamak, konaklama işletmelerinin risklerden kaçınması ve yeni pazar fırsatlarını yakalaması açısından çok önemlidir.

Küresel Plastik Saman Yasaklama Ortamı: Düzenleyici Gelgitler ve Piyasa Değişimleri

A. Mevzuata Uyumun Artırılması: Küresel Plastik Saman Yasaklamalarının Son Teslim Tarihlerini ve Direktiflerini Anlamak

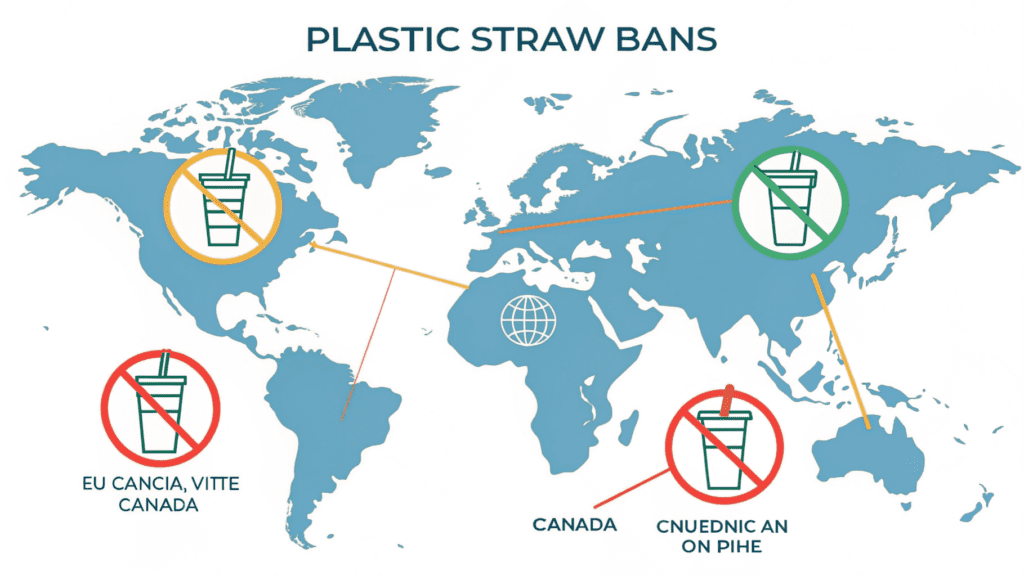

The global legislative tide against single-use plastics, particularly straws, is rising rapidly. The European Union’s Single-Use Plastics Directive (SUPD), effective July 2021, broadly bans plastic straws and other single-use items, specifically targeting items that constitute over 80% of marine litter. This directive places a stringent compliance burden on businesses operating within the EU.

Birleşik Krallık, Brexit'in ardından Ekim 2020'de plastik pipet, karıştırıcı ve pamuklu çubuklara yönelik kendi yasağını uygulamaya koymuş, İskoçya da benzer önlemleri daha önce uygulamaya koymuştu. Atlantik'in diğer tarafında Kanada, 2021'in sonuna kadar pipetler de dahil olmak üzere tek kullanımlık plastiklere yönelik aşamalı bir yasaklama başlattı ve 2030 yılına kadar sıfır plastik atık hedefledi. Amerika Birleşik Devletleri'nde federal bir yasak olmasa da çok sayıda eyalet ve şehir kendi kısıtlamalarını yürürlüğe koydu; örneğin Kaliforniya, tam hizmet veren restoranların yalnızca talep üzerine plastik pipet sunmasını şart koşuyor ve Seattle ve Miami Beach gibi şehirlerde doğrudan yasaklar var. Biden yönetimi, pipetler de dahil olmak üzere tek kullanımlık plastiklerin federal düzeyde satın alınmasını 2027 yılına kadar gıda hizmeti operasyonlarından ve tüm federal operasyonlardan 2035 yılına kadar aşamalı olarak kaldırmayı taahhüt etti.

Asya da agresif bir yolda ilerliyor. Hindistan'ın, aralarında pipetlerin de bulunduğu 19 tek kullanımlık plastik ürüne yönelik ülke çapındaki yasağı 1 Temmuz 2022'de yürürlüğe girdi. Çin, 2025 yılına kadar kapsamlı bir 5 yıllık plan uygulayarak büyük şehirlerde çözünmeyen plastik poşetleri, otellerde ve kurye hizmetlerinde ise plastik ürünleri yasakladı. Fransa'nın döngüsel ekonomi yasası daha da iddialı ve Ocak 2022'den itibaren meyve ve sebzelere yönelik plastik ambalajlar da dahil olmak üzere tüm tek kullanımlık plastikleri 2040 yılına kadar yasaklamayı hedefliyor. Daha geniş hareket, Birleşmiş Milletler tarafından yasal olarak bağlayıcı bir küresel plastik anlaşması için müzakerelerle doruğa ulaşıyor ve kapsamlı düzenlemelerin bölgesel yasakların ötesine geçtiği bir geleceğin sinyalini veriyor.

Küresel düzenlemeler hızla genişliyor ve otellerin ve kafelerin çeşitli ve gelişen plastik pipet yasaklarına uyum sağlamasını gerektiriyor.

B. İtici Güçler: Çevresel Etki ve Değişen Tüketici Tercihi

Bu yasakların itici gücü inkâr edilemez çevresel zararlardan ve tüketici değerlerindeki güçlü değişimden kaynaklanmaktadır. Yalnızca ABD'de günde yaklaşık 500 milyon plastik pipet tüketiliyor; bu miktar, günde 127 okul otobüsünü doldurmaya yetiyor ve ayrışması yüzlerce yıl süren önemli miktarda plastik kirliliğine katkıda bulunuyor. Bu hafif eşyalar, küresel olarak kıyı çöp temizlemelerinde en çok bulunan 10 eşya arasında yer alıyor ve dolaşma ve yutulma yoluyla deniz yaşamı için ciddi bir tehdit oluşturuyor. Plastik, deniz kuşlarının yüzde 60'ından fazlasında ve deniz kaplumbağası türlerinin yüzde 100'ünde bulunuyor.

While plastic straws comprise a relatively small fraction (around 0.025%) of the 8 million metric tons of plastics flowing into the ocean annually, their ban serves as a highly visible and easily adoptable step to raise public awareness. This “gateway issue” has significantly contributed to broader public demand for sustainability. A 2024 Statista survey shows that a striking 85% of respondents across 32 countries support banning unnecessary single-use plastics. This reflects strong consumer demand for sustainability and a clear preference for businesses that align with these values. The “Be Straw Free” grassroots initiative, started by a 9-year-old in the US, significantly contributed to the global movement, highlighting the power of public awareness in driving legislative change.

Consumer demand for sustainability, driven by environmental awareness, is a major force behind global plastic straw bans.

Operational Impact: Adapting to Global Plastic Straw Bans

A. Procurement Challenges & Cost Implications for Hotels and Cafés

For hotels and cafés, the transition away from plastic straws presents tangible procurement challenges and cost implications. Switching to compliant alternatives can lead to increased costs; paper straws, for instance, can be 400% more expensive than their plastic counterparts, albeit still relatively inexpensive at about 2.5 cents each. This seemingly small per-unit increase can accumulate significantly across high-volume operations.

Procurement managers must navigate complex terms like “compostable” and “biodegradable” to avoid “greenwashing” and ensure genuine sustainability. The European Union, for example, has even banned “biobased” or “biopolymer” straws containing any plastic, regardless of “home compostable” certifications, underscoring the need for meticulous vetting. Non-compliance with regulations can result in significant fines and irreversible damage to brand reputation, underscoring the urgency of accurate and compliant procurement. The global paper straw market is projected to reach USD 6.17 billion by 2030, growing at a CAGR of 15.6%, indicating a high and evolving demand that requires sophisticated supply chain management. For a detailed comparison of materials, read our insights onsugarcane straws vs. plastic and paper at Momoio.com.

Hotels and cafés face increased procurement costs and greenwashing risks when sourcing compliant straw alternatives.

B. Waste Management & Enhanced Environmental Footprint

Beyond procurement, adapting to global plastic straw bans significantly impacts waste management strategies and offers opportunities to enhance an organization’s environmental footprint. Most recycling machines cannot properly sort small plastic straws due to their size and composition, leading to 0.025% of plastic straws ending up in landfills or incinerators even when placed in recycling bins. This highlights the inefficiency of traditional recycling for these items.

Adopting certified compostable or truly reusable solutions can streamline waste management by diverting waste from oceans and potentially reducing landfill fees. Hotels like Six Senses Resorts & Hotels already maintain a stringent “no single-use plastic” policy across all locations, substituting plastic packaging with recyclable, reusable, or biodegradable materials and installing glass bottles and water refill facilities in guest rooms. Similarly, the International Tourism Partnership (ITP) supports initiatives like IHG’s commitment to plastic straw removal, which was expected to eliminate 50 million single-use plastic straws annually by the end of 2019. Marriott International is also rolling out wall-mounted shower-product dispensers to replace small single-use shampoo bottles, demonstrating a holistic approach to plastic reduction.

Effective waste management through sustainable straw alternatives improves environmental footprint and operational efficiency.

Navigating Alternatives: A Strategic Guide for Procurement

A. Exploring Sustainable Alternatives to Plastic Straws

The market for eco-friendly straws is innovating rapidly, offering diverse solutions for hotels and cafés.

- Bambu Pipetler: The bamboo straw market is projected to grow from USD 150.7 million in 2025 to USD 320.1 million by 2035, at a CAGR of 7.8%. These are increasingly favored for being biodegradable, reusable, and compostable, and are often preferred over paper straws which tend to get soggy. The foodservice segment is expected to account for 58.6% of the bamboo straw market by 2025.

- Kağıt Pipetler: While early versions were prone to sogginess, advances in waterproof coatings and natural adhesives have significantly improved moisture resistance and durability, making them a more reliable single-use alternative.

- Reusable Straws: Options include durable metal (stainless steel), elegant glass, or flexible silicone. These require robust washing protocols for hygiene and present an upfront investment, but reduce long-term procurement costs. However, stainless steel straws are not recommended for hot drinks due to heat conductivity. Explore more about reusable straws for your business at Momoio.com.

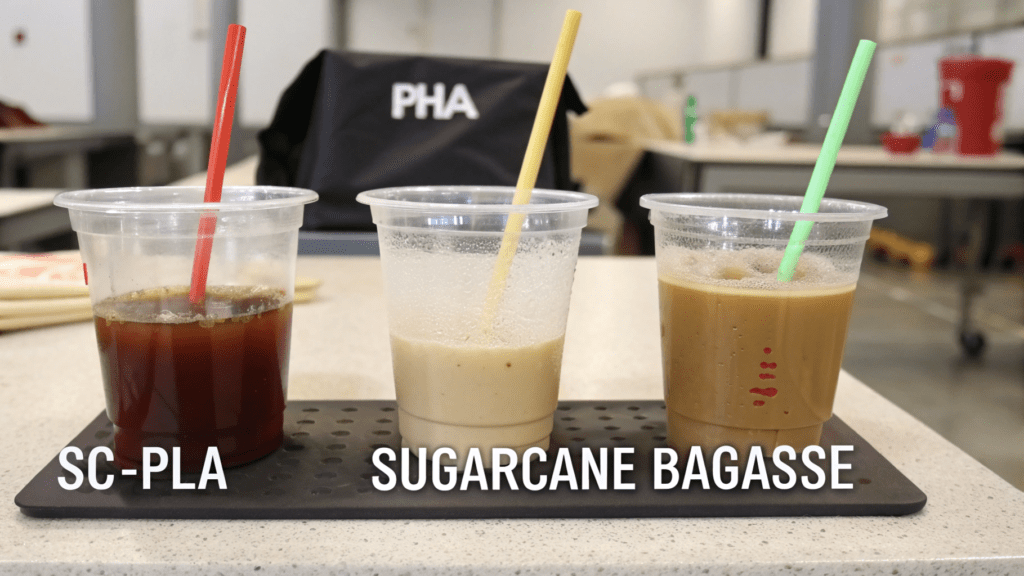

- Emerging Plant-Based Straws: Innovations offer truly biodegradable solutions from materials like sugarcane, coffee grounds, hay, seaweed, and even dried pasta noodles. These options often provide performance comparable to plastic. However, vigilance is key: Polylactic Acid (PLA) straws, while plant-based, typically require industrial composting facilities to break down effectively, posing disposal challenges if such infrastructure is unavailable. For further insights on sustainable alternatives, review our guide to 5 eco-friendly alternatives to plastic and why bamboo tops the list at Momoio.com.

Diverse sustainable straw alternatives offer hotels and cafés options for compliance and enhanced customer experience.

B. Strategic Comparison: Alternative Straws and Their ROI Potential

| Özellik | B2B operasyonel etki | Uyum Notu | YG'nin potansiyeli |

|---|---|---|---|

| Kağıt Pipetler | Higher procurement cost (400% vs. plastic); may impact customer experience due to sogginess of early versions. Improved versions now available. | Generally compliant with bans; ensure certifications for biodegradability and sourcing. | Enhanced brand image, meeting growing consumer demand (65% support bans), potentially higher customer loyalty due to perceived eco-friendliness. |

| Bambu Pipetler | Durable, reusable (if cleaned properly), growing supply chain (58.6% foodservice market by 2025). Can be single-use or reusable. | Excellent compliance, especially where bio-based and truly biodegradable alternatives are preferred. | Premium eco-alternative, strong appeal to environmentally conscious consumers, potential for differentiation and premium pricing, long-term cost savings if reusable. |

| Metal/Glass/ Silicone Straws | Significant initial investment; requires robust dishwashing infrastructure and staff training for reuse. Not suitable for hot beverages (metal). | Fully compliant as reusable items; may need to address accessibility for some patrons (e.g., provide a suitable alternative). | Reduces long-term procurement costs through reuse, reinforces strong sustainability commitment, commands premium pricing for eco-conscious brands, significant positive brand value. |

| Plant-based (Sugarcane/Coffee Ground/Hay) Straws | Performance comparable to plastic. Sugarcane and coffee ground straws are truly compostable, even in home compost. Hay straws are cost-effective. | Compliance varies; EU bans “biobased” straws containing any plastic. Seek clear industrial compostability standards (e.g., ASTM D6400) or truly home compostable options. | Meets regulatory mandates, appeals to eco-conscious market, significantly reduces environmental footprint with proper disposal, potential for product innovation and market leadership. |

Strategic evaluation of alternative straws reveals varied operational impacts, compliance levels, and ROI potential.

Case Studies: Industry Leaders Embracing Global Plastic Straw Bans

A. Hotel Giant Transformation: Marriott International’s Commitment to Sustainability

Marriott International, one of the world’s largest hotel companies, has demonstrated rapid large-scale adaptation to plastic straw bans. By July 2019, Marriott aimed to eliminate over 1 billion plastic straws annually from its 6,500 properties worldwide. This monumental shift sets a precedent for supply chain re-evaluation and commitment to environmental responsibility within the hospitality sector.

Beyond straws, Marriott is rolling out wall-mounted shower-product dispensers to replace small single-use shampoo bottles, targeting plastic reduction in guest amenities. Their efforts extend to reducing plastic use in dining and guest rooms by 2025, actively replacing single-use plastics with sustainable alternatives. For instance, Anantara and AVANI Hotels & Resorts eliminated 2.5 million straws in 2017 across their properties, showcasing the significant volume reduction possible with proactive measures. This strategic pivot by a global leader underscores the necessity and feasibility of large-scale sustainable transitions.

Marriott International exemplifies large-scale hotel sustainability, eliminating billions of plastic straws and expanding plastic reduction efforts.

B. Café Chain Innovation: Starbucks and McDonald’s Leading the Change

Major café and fast-food chains have also successfully pivoted to eco-friendly solutions despite their immense scale. Starbucks phased out single-use plastic straws globally by April 2019 across its 28,000 stores, opting for innovative strawless lids and alternative-material straws. This move reflects a direct response to both regulatory pressures and growing consumer preferences for sustainable packaging.

Similarly, McDonald’s banned plastic straws in international locations like the UK and Ireland and is actively testing alternatives in the US. Their ambitious goal is to transition 100% of their guest packaging to renewable, recycled, or certified sources by 2025. These transformations by high-volume foodservice operations demonstrate that large-scale adoption of eco-friendly solutions is achievable and increasingly expected by the market. This trend is further amplified by companies like Coca-Cola, which aims for 25% reusable packaging worldwide by 2030, including returnable bottles and fountain sales, illustrating a broader corporate commitment driven by consumer demand and environmental responsibility.

Starbucks and McDonald’s demonstrate successful large-scale transitions to sustainable packaging in the foodservice industry.

Beyond Straws: A Broader Look at Single-Use Plastic Reduction

A. Expanding Regulatory Scope: Addressing the Full Plastic Life Cycle

The regulatory landscape is expanding far beyond plastic straws, signaling a comprehensive shift towards addressing the full plastic life cycle. The EU Single-Use Plastics Directive also bans plastic cutlery, plates, and expanded polystyrene containers, indicating a wider regulatory net and a clear signal for businesses to re-evaluate their entire single-use plastic footprint.

China has implemented a comprehensive 5-year plan, effective by 2025, banning non-degradable plastic bags in major cities and plastic items in hotels and courier services. France’s circular economy law is even more aggressive, aiming to ban all single-use plastics by 2040, including plastic packaging for fruits and vegetables from January 2022. The most significant development is the ongoing negotiation for a legally binding global plastics treaty by the United Nations, signaling a future where comprehensive regulations on plastic production, consumption, and disposal will be universally adopted. This international instrument, once finalized, will set global standards and obligations, fundamentally altering how businesses manage plastics worldwide.

Regulations are expanding globally to address the entire plastic life cycle, impacting all single-use plastic items.

B. Future Outlook for Hospitality: The Circular Economy and Strategic Opportunities

The future of hospitality is inextricably linked with the circular economy. The “Global Rules Scenario,” proposed by the OECD, predicts a 90% reduction in mismanaged plastics and a 30% reduction in virgin plastic production by 2040 with comprehensive policy interventions. This ambitious scenario highlights the potential for systemic change and the opportunities it presents for forward-thinking businesses.

For hotels and cafés, embracing a circular economy for plastics—through prioritizing reuse, robust recycling infrastructure, and designing for durability—aligns with evolving consumer expectations and builds significant competitive advantage. Plastic pollution causes an estimated financial damage of EUR 268 million annually to the tourism industry, primarily due to the need for beach and sea clean-ups and tourists avoiding polluted areas, according to WWF. By proactively reducing plastic waste, businesses can mitigate these risks, enhance their brand value, and foster deep customer loyalty. Businesses that differentiate their brand by going beyond immediate regulatory requirements are well-positioned to capture market share in an increasingly environmentally conscious consumer base.

Embracing a circular economy offers hotels and cafés strategic opportunities for competitive advantage and enhanced brand value.

Conclusion: Proactive Sustainability for Enduring Success

The global shift away from single-use plastic straws is not merely a passing trend, but a fundamental transformation driven by pressing environmental concerns and stringent, expanding regulations. Hotels and cafés must strategically navigate these changes, understanding the nuances of regional and international bans, investing in viable and genuinely sustainable alternatives, and reimagining their supply chains for long-term resilience. By embracing this evolution, businesses can ensure compliance, enhance their brand reputation, and contribute meaningfully to a healthier planet while securing their enduring success.

ACT NOW: Evaluate your current plastic usage and develop a phased transition plan to sustainable alternatives. Secure your business’s future and demonstrate leadership in an environmentally conscious market.

Sıkça Sorulan Sorular (SSS)

What are the primary risks for hotels and cafés ignoring plastic straw bans?▼

Ignoring plastic straw bans can lead to significant fines, severe reputational damage, and loss of customer loyalty, directly impacting revenue and market standing for hotels and cafés.

How do global plastic straw bans impact procurement costs for hospitality businesses?▼

Switching to compliant alternatives like paper or plant-based straws can increase procurement costs, with paper straws potentially being 400% more expensive than plastic, requiring careful budget planning.

What are the most effective sustainable straw alternatives for high-volume hotel and café operations?▼

Effective alternatives include improved paper straws, reusable bamboo or metal straws, and emerging plant-based options like sugarcane, offering durability and compliance for high-volume use.

How can hotels and cafés ensure their chosen straw alternatives are genuinely eco-friendly and not ‘greenwashing’?▼

Businesses must meticulously vet certifications (e.g., ASTM D6400 for compostability) and understand material breakdown requirements, avoiding ‘biobased’ plastics that still contain non-degradable components.

What is the long-term ROI of investing in reusable straws for hospitality businesses?▼

While requiring an initial investment in washing infrastructure, reusable straws significantly reduce long-term procurement costs, enhance brand image, and appeal to eco-conscious consumers, yielding substantial positive brand value.

While requiring an initial investment in washing infrastructure, reusable straws significantly reduce long-term procurement costs, enhance brand image, and appeal to eco-conscious consumers, yielding substantial positive brand value.